Staying Afloat in a Sea of Contradictions

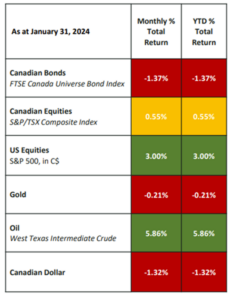

Coming off the December 2023 market euphoria, January 2024 market returns were considerably more muted and decidedly mixed across regions and asset classes. Canadian and US markets continued to reflect mixed views on the possible state of the economy, with economic scenarios ranging from a possible soft landing vs. concern over a recession, and even talk of stagflation.

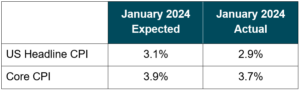

And now into February, this week’s announcement confirms inflation is proving stickier than expected.

The year has left behind December’s unanimous positivity and is back to the ‘new normal’ regime of heightened uncertainty and wider possible outcomes, as reflected in market returns. Stock markets appear optimistic, pricing in a soft landing, while the bearish bond market anticipates a recession. Investors remain hyper-sensitive to news.

Against a backdrop of strong employment, positive earnings, and sticky inflation, monetary policy is expected to remain tight, with the market expecting cuts later in the year (and I’d agree!). This is in stark contrast to a highly expansionary fiscal policy, never seen before at this stage of the cycle (i.e., governments typically increase fiscal spending when a recession has begun). We do not believe labor pressure has abated and expect to see further inflationary pressure in this area. Housing remains structurally challenged and inflationary. Previously, I’ve shared about the divergence between the broad US economy and the more cyclically sensitive Canadian economy. This disconnect extends further when examining the relative strength of North American economies vs. regions such as Europe, Japan, and China, which are registering a slowdown and/or recession. The impact of foreign recessions is expected to impact North America, indicating that recession risk is decidedly still on the table.

Equities

Both the S&P 500 and the S&P/TSX Composite delivered positive returns in January, gaining 3.0% and 0.6% respectively.

Canadian equity returns were more muted, reflecting Canada’s slower growth story vs. the US. The market was weighed down by commodities, which were under pressure from an appreciating US dollar. Crude oil posted gains of 5.86%, at $75, reflecting positive US news and continued geopolitical tensions.

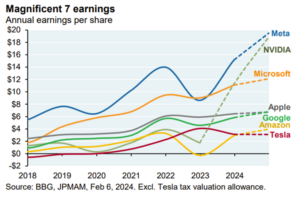

January’s US equity returns reflected optimism around a strong January employment report, better-than-expected earnings reports, and renewed confidence in an AI boom. The on-again/off-again tech story was decidedly on-again in January, as “Magnificent 7” (or “Mag 7”) tech stocks such as Meta reported positive earnings.

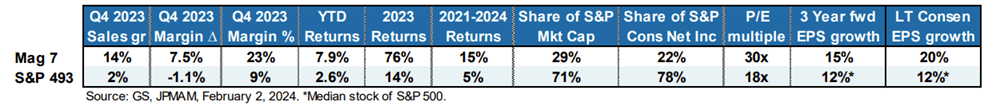

On the face of it, US equity returns appeared optimistic, with the market reflecting the prospect of a soft landing. And indeed, into early February, many earnings reports exceeded analyst expectations. However, a look behind the curtain may reveal a more concerning backdrop. In its most recent Eye on the Market publication, J.P. Morgan’s Chairman of Market and Investment Strategy, Michael Cembalest, reported the following data on the Mag 7:

JP Morgan estimates of the Mag 7’s 28% return since 2019, 21% is attributable to sales growth, while 6% is driven by margin expansion, with only 1% driven from multiple expansion. This data provides comfort that the current tech rally is not a replay of the low/no-earnings tech bubble of 2000–2001.

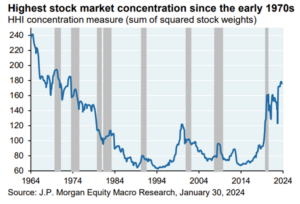

Interestingly, studies conducted by J.P. Morgan’s Marko Kolanovic and Dubravko Lakos-Bujas revealed:

- • “Market concentration has reached its highest level since 1972. The top 10 stocks have broken away from stocks #11–#50 to an even greater degree than during the tech bubble in 2000–2001.

- • Large spikes in market concentration have frequently coincided with or preceded prior recessions.”

While seemingly optimistic on the surface, market concentration suggests the broader equity market is hiding a more sober, possibly recessionary outlook.

Fixed Income

Fixed income markets registered negative returns, reflecting surprise at stronger-than-expected US economic data and the implication of delayed rate cuts in the US. Rate volatility was low during January vs. previous months. At current rate levels, demand for investment grade credit remains strong. New issuance set a record at almost $13B in Canada and a whopping $240B in the US. Despite such a high level of supply hitting the bond market, the demand for high-quality corporate bonds was still higher, leading to Canadian and US credit spreads tightening (between 6 bps to 126 bps in Canada).

Is Cash Still King?

It is hard to believe cash rates were 0.25%in early 2022. In the past year and half, frenetic interest rate hikes drove short-term rates up to 5% in Canada. In 2023, High Interest Savings Account (HISA) purchases (or HISA ETFs), were arguably the hottest retail trade.

Short-term rates remain elevated and the argument for cash still holds. However, a recent regulation implemented on January 31, 2024, by OSFI, the regulatory body overseeing Canadian banks, is expected to reduce the competitiveness of interest rates available in HISA strategies. Already, HISA have shown a drop in rates available and changes in composition since this regulation was implemented.

In an upcoming blog from Harbourfront’s Office of the CIO, we will review recent regulatory changes, the merits of various cash vehicles, and what these changes mean for investor portfolios. As always, please connect directly with your Harbourfront advisor.

Private Markets

As talk of a possible recession continues to worry Canadians, many investors are asking: “What about investing in private assets?”

Private assets continue to be an attractive and diversifying asset class. In recessions, markets and investors can experience a higher need for liquidity. Reasonable liquidity is an important part of your portfolio’s overall allocations.

Private credit. Typically, in a recessionary environment, credit risk increases as companies struggle to meet their debt obligations. A few key factors protect investors against this risk:

- • Quality of the private asset manager. The depth, strength, and diversity of a manager’s investment platform are critical to advising investors on holding the ‘right’ credit risk.

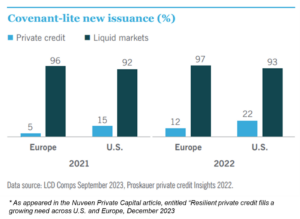

- • Degree of control on the credit risk. Many areas of the private credit space allow the lender(s) a higher degree of oversight, reporting, and control on a private bond vs. what is available in public bonds. This is important in a credit event because lenders can help investors recover a higher level of capital and return.

As illustrated in the chart below, most private debt issuance requires ongoing covenant reporting to help lenders understand on an ongoing basis the credit worthiness of its borrowers. This reporting is not required in public bonds. Private lenders have a greater line of sight on possible issues and higher control in a credit event.

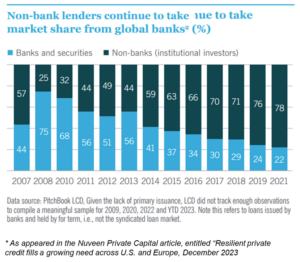

- • Positive lending environment. The overriding trend continuing in 2024 is the unidirectional displacement of traditional banks in favour of other institutional investors, including private credit.

Overall, we believe private credit remains well-positioned to be the ‘belle of the ball’ for the foreseeable future.

Regarding private equity. Following a strong bounce-back year in private equity in 2021, 2022, and 2023, we saw a notable slowdown in private equity, bottoming out in the summer of 2023. Hot off the presses at Prequin Pro, Q4 2023 data continues to confirm that private equity activity is picking up, with tech-oriented private equity leading the way.

Private real estate and mortgages.

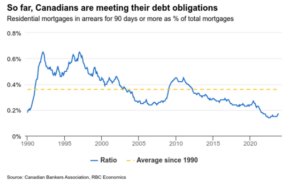

In Canada, many fixed rate home-owners will go through renewal payment shock, which is expected to provide some lift in single family home sales. That said, RBC Economics & Thought Leadership’s January 2024’s Focus on Canadian Housing states, “most mortgage holders have been stringently stress-tested against a spike in rate – qualifying at a rate at least 2 percentage points above the rate they received – at origination.” Prudent underwriting by the Canadian mortgage sector has significantly contributed to maintaining mortgage delinquencies at historically low levels to date.

We believe the Canadian housing market could heat up if rates decline at the end of the year. The low affordability level continues to support housing such as apartment rentals, and rent growth continues.

As always, we remind our investors that the objective of this outlook is not to predict the future, but to consider the most important factors in making decisions today. In this sea of contradictions, we remain confident our positioning is in alignment with key mega trends.

If you would like to discuss your portfolio, I’d encourage investors to connect directly with your advisor.

Disclaimer

I, Christine Tessier, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q3 2025

3 October 2025