Stumbling towards a mild recession?

“Despite an optimistic equity market and headline numbers showing resilience, underlying economic trends show a mixed picture. The economy may stumble into a mild recession. Inflation has sufficiently dropped as to finally merit rate cuts later this year. Rate cuts may be less frequent or substantial than anticipated, as inflation may stay at the 2.5–3% level for longer than expected. Within private markets, while pent-up demand will provide a pick-up in activity, higher financing costs will force deal makers to sharpen their pencils on valuations.”

– Harbourfront Wealth Management’s Office of the CIO updates on US and Canadian monetary policy from Chief Investment Officer Christine Tessier.

US Monetary Policy Update

Since the Global Financial Crisis, the tone of the Fed has been, in and of itself, a monetary policy tool that moves markets up or down. This past Wednesday, the Fed announced it would hold rates steady, between 5.25% to 5.5%. The Fed struck a dovish tone, projecting three interest rate cuts for 2024, despite moving up its inflation forecast (from 2.4% to 2.6% year-over-year) and GDP expectations (from 1.4% to 2.1%), with a year-end expectation for the Fed funds rate to land around 4.6%. Markets reacted positively to this dovish tone, leading to a broad-based rally across financial markets, with equities, gold, silver and bitcoin all posting gains. The yield curve has lightly steepened in response to expectations that rate cuts are coming.

The tone of Chairman Powell’s press conference remarks, while dovish, seems caught in a delicate balancing act between keeping inflation at bay while managing households and unemployment. There has been a significant weakening in the household survey, indicating—inflation print aside—the population remains pessimistic about prices. And yet, the Fed projected a slightly lower unemployment rate, moving its projection down from 4.1% to 4.0%. In the US, earnings season was stronger than expected, and several data points show inflation coming down, albeit in a ‘bumpy’ fashion.

Canadian Monetary Policy: Divergence from the US

Canada’s inflation print on February 20, 2024, was decidedly more up-beat, with headline Consumer Price Index (“CPI”) clocking in at 2.9%, well below the 3.4% that was anticipated. Inflation outlooks were glum on expectations of negative impacts due to increased mortgage costs. However, for the second month in a row, Canada’s CPI dropped thanks to softness in energy, food, airfare, and clothing. Higher rates are showing a slowdown in the Canadian economy, with both consumers and business pulling back spending. Canadian growth is expected to remain soft in the early part of the year. Labour conditions have eased, with job vacancies returning to pre-pandemic levels. Current data suggests the economy is in modest excess supply.

Our view

In previous commentaries, and at then-higher-prevailing inflation rates, we anticipated inflation would remain a concern for longer than expected, and rates, which had likely peaked, would remain high. This view has materialized, with no rate cuts in H2 2023 or in Q1 2024. As the impacts of previous rate increases continue to soften inflation, we now expect some rate cuts to occur. We do not envy the role of central bankers, who must manage the delicate balancing act between inflation vs. employment. We remain concerned that the economy may stumble into a recession. Data is likely to continue to show softness, leading to rate cuts later in 20204. However, key mega trends continue to drive inflationary pressure. We believe it is possible that rate cuts may be less than anticipated, as inflation may stay at the 2.5–3% level for longer than expected.

RECAP OF FEBRUARY 2024 & LOOKING AHEAD

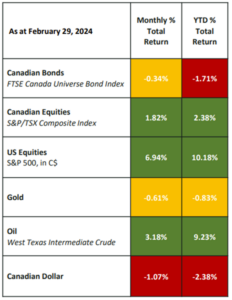

Please see the table below for a summary of February’s market returns. Once again, the S&P 500 and the S&P/TSX Composite delivered positive returns in February, gaining 6.9% and 1.8% (in C$ terms), respectively.

Private Assets

Coming off a record peak activity in 2021, and following a difficult year for private markets in 2023, the private assets sector has worked hard to convince investors that brighter days lie ahead. Now early into 2024, March shows us signs that M&A is returning. Economic resilience in the US and broad market expectation that interest rates will soon decline has spurred optimism. More importantly, impatient demand that was lying in wait throughout 2023 is ready to move. The backlog of companies waiting to go public has grown; there is cautious optimism regarding an IPO recovery in 2024. However, this deal-making environment differs from 2020–21 in an important way. While the 2023 lows provided room for increases in multiple expansions, the current higher level of interest rates makes deals more expensive than in previous M&A booms. A higher cost of capital creates a tough underwriting environment and puts a downdraft on valuations.

According to the Global M&A industry trends 2024 outlook, “The M&A starting bell has rung. Are you ready?” by Brian Levy, PwC United States’ Partner and Global Deals Industries Leader, private capital has:

- • Almost U$4 trillion in ‘dry powder’—capital which needs to be put to work or returned to limited partners.

- • Approximately U$12 trillion in assets under management, highlighting the significant build-up in unrealized value in portfolios over the past three to four years.

Private equity firms face pressure today to return capital to investors, which is expected to lead to an increase in deal activity. If you would like to discuss how this relates to your portfolio today and in the future, I’d encourage investors to connect directly with your advisor.

Disclaimer

I, Christine Tessier, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q1 2025

10 April 2025