How low can Canada’s rates go?

In the latest update from Christine Tessier, Chief Investment Officer of Harbourfront Wealth, she says goodbye to Q1, takes stock of key economic indicators, and provides an update on our economic outlook.

- • We continue to view inflation as a risk, given the impact of mega-trends;

- • Economic data continues to show growing divergence between Canada and the US, which is expected to soon be reflected in interest rate policy action;

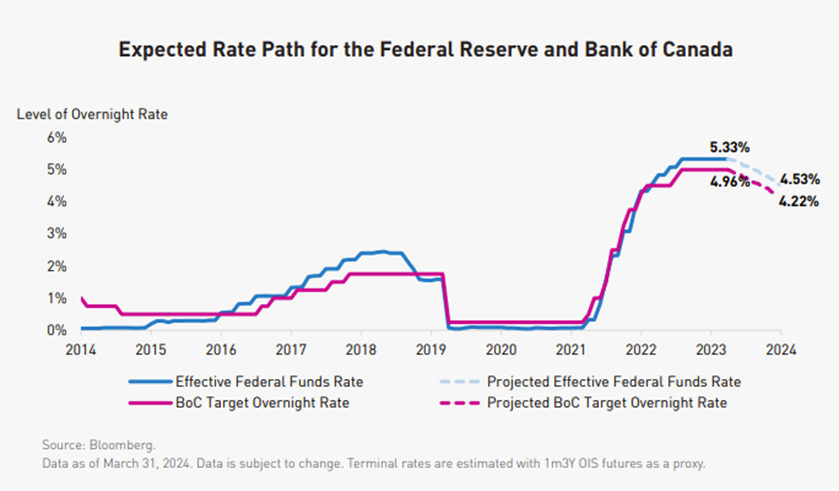

- • We see little motivation for the Fed to cut rates and expect US rate cuts to be muted in 2024; Canada is expected to lead the way, with a rate cut expected by mid-summer, but may be limited in its divergence from the US.

In Canada

- • GDP Growth. The Canadian economy began the year upbeat, with January’s GDP growth surprising to the up-side at +0.6% month-over-month. Growth in the economy was primarily services-driven (+0.7%), though goods also contributed positively (+0.2%). Market participants are upbeat, hopeful for another positive data month for February 2024. The Bank of Canada’s April 2024 Monetary Policy Report revised its 2024 GDP forecast upward to 1.5%, up from a previous forecast of 0.8%.

- • Similarly, inflation was another positive surprise, coming in lower in February at 2.8% year-over-year. The most notable contributor to the decline in inflation was grocery prices, while items such as cell and internet services also contributed to the decline. Gasoline and shelter price inflation remained positive and items to watch.

- • The Canadian labour market lost jobs in the first quarter vs. expectations of further job creation, registering a +0.3% increase in unemployment to 6.1% at March 2024. Interestingly, wages are up +5.1% year-over-year.

- • Policy rates. Despite much talk about interest rates cuts, the Bank of Canada continued again this week to hold its overnight rate at 5%.

In the US

- • GDP Growth. US resiliency continues to defy expectations, keeping headlines strong throughout Q1 2024. Similar to Canada, interest rate increases have slowed economic growth in the US over the past year. However, the Fed has increased its 2024 GDP projection from 1.4% (December forecast) to 2.1% (March).

- • Q1 marked a steady stream of disappointing inflation data in the US. March marked the 3rd straight month of inflation remaining above the Fed’s target 2% level, after having steadily dropped in the second half of 2023.

- • The US economy’s theme of resiliency shone through its employment updates. Again, in March, the US economy added 303K jobs, well above expectations. The unemployment rate dipped to 3.8%.

- • Policy Rates. Despite the progress made on inflation, the discussion has centered around upside risks to the inflation outlook. Hence, our March update continued to reinforce the Fed’s position to maintain the Fed Funds Rate between 5.25% to 5.5%.

Updated Outlook

Reflecting on our January 2024 outlook, we expected to see divergence between Canada and the US, with Canada being more susceptible to recession risk. This forecast appears to be slowly materializing, as current economic data illustrates that the Canadian economy is showing greater softness—most notably in employment and growth—than the US. The resiliency of the US economy surprised us, though the inflation uptick did not, given current mega trends. While some market participants interpret the 2024 inflation print as a data aberration, we view the broad-based nature of inflation data too widespread to ignore and indicative of both mega-trends-at-work and high fiscal spending. We now believe the risk of a US recession has decreased, though is still not fully off the table. We continue to believe Canada is at risk of a recession.

One data point of interest is the divergence between US and Canadian employment data. Although Canada does not appear to be creating new jobs, it continues to register wage growth, which is surprising given the uptick in unemployment. Conversely, the US continues to create new jobs; however, wage growth is slowing, and US headlines now prominently report corporate job cuts.

The economic landscape is difficult to predict as market participants continue to react strongly to small data point changes. For instance, this includes notable changes to expectations from six rate cuts (January) to three rate cuts (March), as reported by RPIA and Bloomberg in the table below.

Source: Credit Market Themes in 5 Charts – Q1 2024 (rpia.ca)

Regarding inflation overall, we see a difference between the industry’s data-point-to-data-point tracking of inflation vs. the individual consumer’s lived experience and behavioural bias. While inflation has steadily trended downward, everyday consumers continue to report negative sentiment around prices, as is reported through household surveys. Key areas of household spending may be under-represented in inflation calculations, most notably areas such as infrastructure costs. Consequently, while inflation print may have declined, the consumer continues to behave under the pressure of higher price levels that have not returned to pre-pandemic levels.

In the US, we are hard-pressed to see why the Fed would rush into any rate cut before the latter part of the year. We believe central bankers are keen to avoid ‘the ghosts of inflation past’ by not taking its foot off the break too soon. In our view, the US’s economic data does not support a rate cut, given economic and employment strength. Further, the Fed is unlikely to be satisfied with one negative inflation print and may want to see the inflation fire definitively put out before cutting rates. Hence, rate cuts are unlikely before the fall (if at all).

In Canada, headlines abound with Canadians asking, “when is the Bank of Canada going to cut rates?” With softer economic and employment data, Canadians are keen for rate relief. Unfortunately, this puts Canada in the unenviable position of potentially being first to cut rates, with blurred visibility on whether the Fed will follow suit. A divergence in policy rates puts downward pressure on the Canadian currency and has broader implications on import/export prices. There is also the question: how much divergence in policy rates is possible? Although Canadian data suggests a rate cut could be warranted in June, we believe it’s equally possible for the Bank of Canada to push it off a little, to buy time to obtain better visibility and hopefully better align with Fed policy. Would the Bank of Canada provide substantial rate cuts (over 50 bps) without seeing some movement in the US?

Finally, one of the growing concerns we see regarding economic data is the extent to which private market activity is reflected in the information reported. As capital is increasingly shifting towards private markets, it is unclear the extent to which this economic activity is captured in key economic indicators.

Fixed Income

Volatility continues to be high as markets speculate on the direction of interest rates. After a strong end-of-year rally in 2023, the FTSE Canada Universe Bond Index posted a -1.2% return for the quarter. Regarding credit, both US and Canadian issuers have been very active. In March, Canadian companies issued approximately $12B in new bonds. The quarterly issuance level was over 60%+ higher vs. 2023. Market participants continue to view fixed income (particularly investment grade fixed income) as offering attractive all-in yields, and are keen to purchase bonds priced at current higher levels. Despite record-level issuance, demand kept pace with supply. Many bond managers expect the issuance calendar to slow down as the year progresses. Considering the high levels of bonds maturing and expectations of a slow-down in issuance, the market could be positive for credit spreads.

Equities

The first quarter of 2024 got the year off to a strong start with the S&P 500 (in CAD) and S&P/TSX Composite gaining 13.34% and 6.62%, respectively. Energy was a strong driver of returns, as oil prices climbed on geopolitical tensions. In Canada, equity market performance was ‘classically Canadian,’ with positive sector returns from Materials (+16.6%) and Energy (+8.7%). Healthcare was also a strong performer at +13.6%. US sector returns followed a similar trend, with Energy registering the strongest returns (+11.1%), a welcome change from the ongoing tech story. Market indices continued to flirt with new record high levels throughout the quarter. Canadian equity funds experienced inflows, reflecting investors’ interest in commodities amidst continued inflation concerns.

Private Assets

Interest in private assets remains stable, as investors continued to seek respite from public market volatility. Headlines were focused this past month on the growing number of private strategies available to the Canadian retail market.

- • Private debt continues to attract capital. Major private debt players point to a massive imbalance in supply/demand dynamics in this space. Private credit manager Hamilton Lane estimates the supply shortage at U$854B.

- • We continue to see signs that private equity markets are moving. Concerns around NAV values remaining too high appear to be abating in most private equity sub-sectors. The one exception is venture capital, where valuations have come down and appear cheap but many believe there is further downdraft to go.

- • Similarly, headlines were active in speculating whether the US real estate market has bottomed out. Prominent private market participants such as Blackstone and Goldman Sachs have signaled their intention to ‘resume active investment’ in US real estate. Redfin’s CEO is quoted as saying the housing market has bottomed. We continue to remain positive on private assets and specifically are on watch for opportunities in US real estate. Supply/demand dynamics remain positive for real estate. 2023 saw major declines in the availability of construction financing, which has created a tightness in supply, particularly in key sectors such as Multi-Family Residential. Real estate debt roll-overs have led to forced selling, creating opportunities for equity funds to purchase quality properties at a discount. Both trends provide attractive opportunities in real estate equity investing.

- • Infrastructure remains an important and under-explored theme in private markets. We see a disconnect between the support for real estate vs. the comparatively muted attention given to infrastructure. Challenges exist in infrastructure investing, where minimum deal size is typically large and investment terms are long (e.g., government contracts can be 30+ years). Huge capital is needed to keep pace.

If you would like to discuss your portfolio, investors should connect directly with your advisor.

Disclaimer

I, Christine Tessier, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q1 2025

10 April 2025