Will 2025 be a “Golden Vintage" for Private Markets?

Harbourfront’s Chief Investment Officer, Theresa Shutt, shares her perspective on how lower interest rates will impact private market investments.

Harbourfront’s Chief Investment Officer, Theresa Shutt, shares her perspective on how lower interest rates will impact private market investments.

Finally, at long last, the era of “higher for longer” seems to be at an end. Most developed economies have now shifted to monetary easing with Canada leading the pack with four rate cuts since June. With the economy still in a state of lingering excess supply, more cuts are expected.

Interest rates serve as a critical lever in the economy, influencing borrowing costs, consumer spending, and investment decisions. In a low-interest-rate environment, returns of different asset classes may vary significantly, prompting investors to allocate capital differently than they would under a higher rate environment. With some traditional investment vehicles offering lower returns, fund managers and individual investors will increasingly turn to private markets to achieve target returns.

The size of the private market has grown significantly with $13 trillion in assets under management globally(1). As the market continues to evolve and expand, investors now have access to a broad range of private market investments. Not all products are created equal, however. While the opportunity set for private market investing will become more attractive in a lower interest rate environment, the asset class remains highly opaque requiring significant expertise and experience to select the right managers.

Like a bottle of wine, not all private market investments will age well; some may even turn to vinegar!

Private credit

With the majority of private credit strategies invested in floating rate debt, lower interest rates will create downward pressure on total yields for private debt. Compared to public fixed income, the relative yield of private credit remains highly attractive.

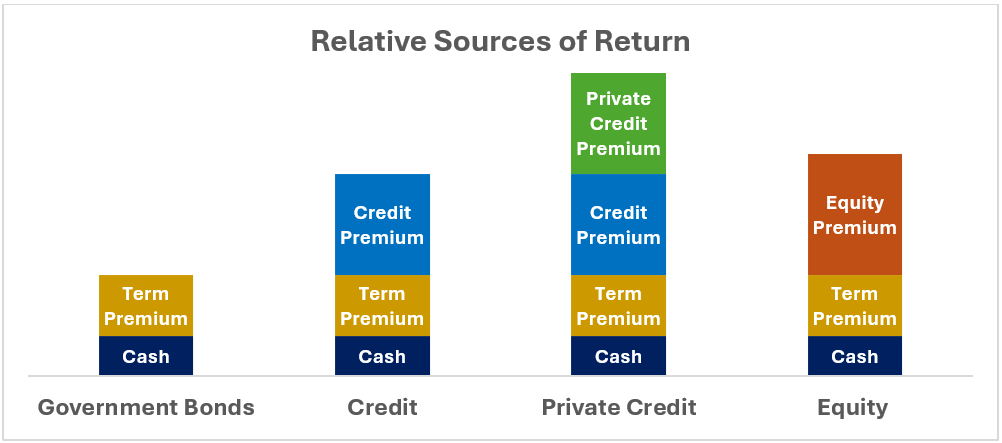

Private debt financing is highly customized to meet the unique needs of each borrower. As a result, private debt managers are able to charge a higher interest rate—often referred to as a “uniqueness” premium. Moreover, like all private market investments, private credit provides enhanced returns due to the “illiquidity” premium, which represents the extra return investors receive for holding assets that are not easily convertible to cash. Historically, these sources of yield premium generate 200 to 300 bps of additional spread when compared to similar public bond investments.

For illustrative purposes only

For illustrative purposes only

Lower rates also reduce debt servicing costs for the underlying borrowers, which significantly reduces the potential for defaults and loan losses—thereby improving the investment quality of private debt investments.

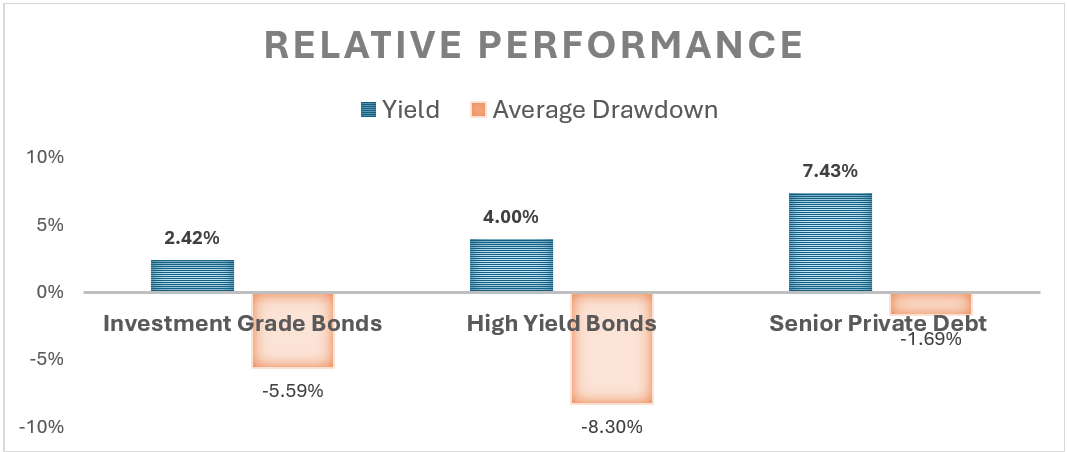

Consider the comparative returns and average drawdowns for public and private debt during the low interest rate period from 2011 to 2020.

Source: Purpose Investments

Private credit is a loan extended to a non-public company. The Cliffwater Direct Lending Index-Senior (CDLI-S) are used to represent the private credit market. Yield is calculated by taking the average yield of the loans within the respective index. Average drawdown is calculated as the average of each years’ best performing quarter less the worst performing quarter. Time period is 03/31/2011 – 03/31/2020.

With enhanced yields and lower loss rates than traditional asset classes, private credit investments serve as an attractive complement to public fixed income.

Private equity

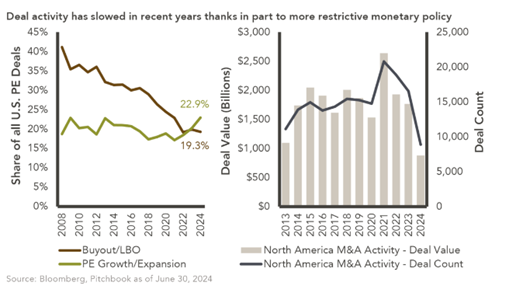

Private equity has been more challenged over the past two years, marked by declines in both deal activity and recent performance relative to stronger returns generated in previous years. Since the asset class is heavily reliant on debt leverage to fund deals, private equity activity has been impacted by the historic rise in interest rates that has made debt more expensive over the last several quarters. Traditionally, private equity borrows approximately 40–50% of the purchase price of the companies they acquire so higher interest rates have a meaningful impact on private equity returns. Overall, higher rates have resulted in fewer private equity deals done and fewer opportunities to sell companies at higher multiples to generate higher returns.

The path to lower rates will be a highly welcome stimulus for private equity investors. To the extent that lower interest rates decrease borrowing costs and allow for more leverage, merger and acquisition (“M&A”) activity will increase as companies look to grow through acquisitions and consolidate with peers to better position their business for success.

While a recovery in activity won’t occur overnight, private equity firms are preparing for a significant increase in deal making on the horizon. Over 2024 M&A activity has already shown strong signs of recovery. In the first half of this year, North American M&A activity advanced by roughly 13% on a year-over-year basis in terms of both deal count and value (including estimates for unreported deals).

![]()

Source: E&Y-Parthenon; US corporate M&A deal volume (count of deals) for disclosed deals > $100mm, with historical data in 2015-23 from Dealogic and forecasted values in 2024-25 from EY-Parthenon.

By reducing debt service costs, lower interest rates also lead to higher cash flows for private equity portfolio companies which increase returns and distributions. Lower borrowing costs provide more excess cash flow to facilitate future deal activity for private equity owned businesses. Bottom line, more cash flow provides companies with the flexibility to pursue new acquisitions, initiate organic growth initiatives, and ultimately, drive potentially higher returns for private equity investors.

Finally, interest rates and equity valuations are inversely correlated; lower rates lead to higher valuations for private equity, which is expected to revive exit markets—particularly IPOs.

Overall, lower rates will allow for higher levered returns, increased deals activity, greater opportunity for exits, and higher valuations. These tailwinds are expected to drive better investment outcomes for private equity investors.

Private real estate

Real estate is highly sensitive to interest rates due to the impact on both borrowing costs and capitalization (“cap”) rates. Cap rates measure the ratio of a property’s net operating income (“NOI”) to its purchase price. Declining interest rates reduce the cost of borrowing, enabling investors to pay more for properties while maintaining desired returns (NOI) which leads to cap rate compression. As a result, periods of declining interest rates historically coincide with falling cap rates, leading to higher real estate values. The potential for higher real estate valuations will become a key driver for investors to re-enter the market now. With interest rates expected to continue their downward trajectory, investors can anticipate a potential for real estate value appreciation.

As interest rates decrease, cash flow coverage also increases, bringing down loan loss reserves for banks, resulting in more bank credit being made available to the market to facilitate deal flow.

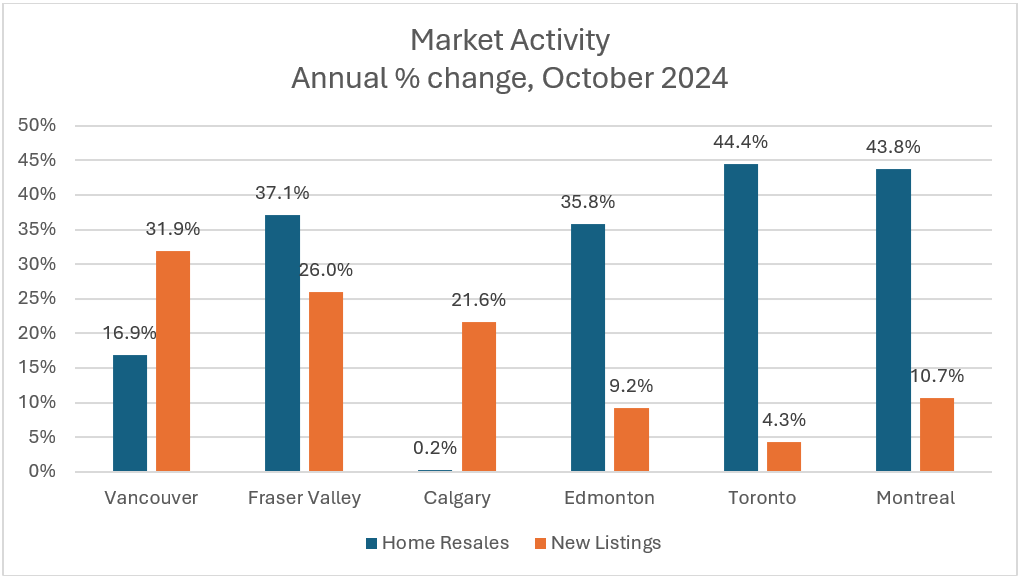

Within the real estate market, certain sectors are particularly well positioned to offer attractive returns. Residential real estate is experiencing high demand due to population growth and immigration, especially in urban areas. Moreover, with lower mortgage rates increasing home affordability, the residential sector will see more entrants in the market as people seek to take advantage of favourable borrowing conditions combined with the upcoming relaxation of mortgage insurance rules.

In the multi-family sector, lower rates present investors with opportunities to refinance properties to free up capital for new purchases and expand into new markets and sectors, as seen with the increased activity in real estate across Canada.

Source: REBGV, FVREB, CREB, RAE, TRREB, QPARES, RBC Economics

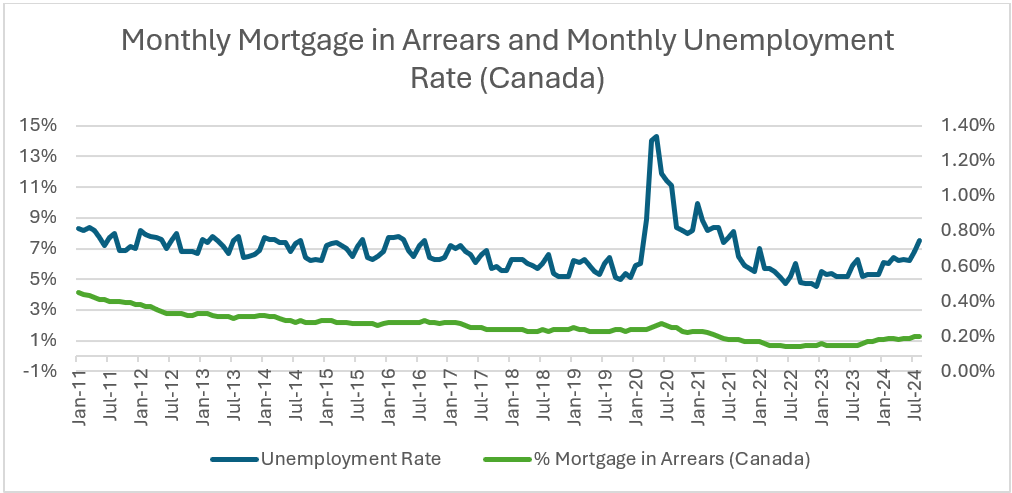

Even in times of stress, multi-family residential real estate generally performs well. Despite the increase in the unemployment rate in both 2020 and 2023, home owners continued to make their mortgage payments.

Monthly Canadian unemployment rates – Source: Organization for Economic Co-Operation and Development

Monthly Mortgage Arrears – Source: Canadian Bankers Association

Industrial real estate is also experiencing strong tail winds, driven by the e-commerce boom and supply chain demands. In Canada, record low levels of vacancy have kept demand for industrial property at high levels. Lower interest rates will facilitate the expansion and acquisition of warehouses and distribution centers, crucial for meeting the rising demand in this sector.

Private real estate tends to be less volatile in an environment experiencing sharp interest moves. Unlike REIT investors, private investors have longer term horizons and trade less on emotion and more on overall NAV which considers both cap rates and cash flow.

Implications for private market investment strategies

Lower interest rates will significantly shape the landscape for private market investing.

For private credit, reduced borrowing costs facilitate greater opportunities for investing as companies seek debt capital to finance growth. In private equity, lower rates will allow for increased deal activity, higher valuations, and more exits, resulting in higher returns and distributions to investors. A declining interest rate environment for real estate will lead to lower cap rates to raise real estate values and create more cash flow to finance redevelopment and acquisitions.

Overall, lower interest rates are expected to significantly increase the opportunity set for private market investing as well as create strong fundamentals to access higher quality investments at attractive risk-adjusted yields. With tailwinds like these, 2025 may indeed be a “Golden Vintage,” for private market investing.

Both wine making and investing, however, require highly specialized knowledge. Wine makers must have extensive knowledge of grape varietals, climate, soil nutrients and growing techniques to produce a great bottle of wine. They must also have a skilled palate capable of identifying subtle differences. Similarly, private market investing requires specialized expertise and experience to understand the complexities and nuances of these opaque asset classes.

Not all managers will produce a good vintage. When selecting managers in private markets, it is critical to employ disciplined due diligence and to have robust processes in place to continually monitor manager performance and proactively adjust allocations as needed. Moreover, by adopting a diversified approach to optimize exposure to private markets, investors can access broader opportunities for enhanced returns while achieving overall lower volatility. Like wine, you need different varieties for different occasions!

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q2 2025

7 July 2025