Tariffs and Trade Wars: The Ultimate Zero Sum Game

Background

On November 25th, President-elect Donald Trump announced on social media that as one of his first executive orders, he would impose a 25% tariff on all products imported into the U.S. from Canada.

Canada is highly reliant on trade with the U.S., with exports to the US accounting for nearly 77% of Canada’s total exports. A 25% across-the-board tariff would be highly detrimental for the Canadian economy, resulting in unprecedented job losses, severe supply chain distribution and an estimated reduction in real GDP exceeding 2.4%1.

The timing of this threat is particularly distressing considering the Canadian economy was finally poised to emerge from a period of depressed activity. The Canadian economy was projected to grow by 2.0% in 2025; this growth could now be completely eradicated with the impending hit to the trade volumes2.

The negative impact of the proposed tariffs would likely not be limited to Canada, as the U.S. consumer would bear the economic burden of higher input costs. Alternatively, to the extent that US importing firms absorb the cost of tariffs, their profits would shrink. While the impact on the U.S. will be less negative, a 25% tariff on Canadian imports is expected to decrease the growth of U.S. economy by approximately 1%2.

Over the long run, tariffs slow economic growth by reducing income and investment as well as lead to dynamic inefficiencies which reduce productivity.

Implications for the Canadian economy

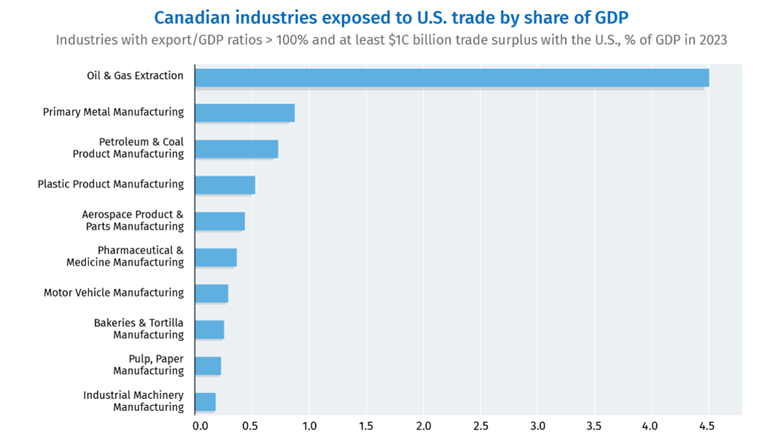

Industries heavily reliant on integrated supply chains would be hit the hardest. In particular, the automotive sector would face significant cost increases and disruptions. The energy sector, chemical and plastic manufacturing, forestry products, and machinery sectors are also highly vulnerable.

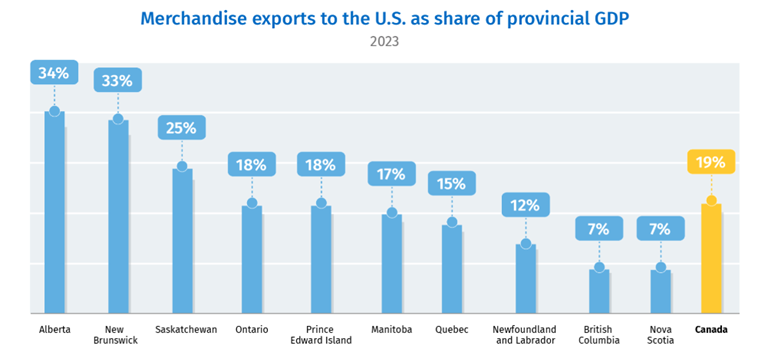

The implementation of U.S. tariffs is expected to vary significantly across Canadian provinces. Quebec and Ontario would be impacted with respect to motor vehicles, metals and the aerospace industry, while Alberta, Saskatchewan and the Maritimes would feel the impacts of tariffs on energy.

Source: RBC Thought Leadership ‘Proof Point: Canadian industries and provinces most exposed to U.S. tariff threat’

Despite Trump’s rhetoric that Canada needs the U.S. to “stay afloat”, most of the trade deficit is caused by oil exports. Roughly 25% of oil going through American refineries and then consumed in the U.S. is Canadian. In 2023, 60% of U.S. crude oil imports came from Canada, an increase from 33% in 20133.

Source: RBC Thought Leadership ‘Proof Point: Canadian industries and provinces most exposed to U.S. tariff threat’

To better understand both the impact of and the potential for these tariffs, let’s focus on a few facts:

How and when can tariffs be implemented?

According to Article 1, Section 8 of the U.S. Constitution, Congress holds the power to impose tariffs, not the president. However, over the years, Congress has passed multiple laws ceding some of that power to the president.

In practice, how quickly any new US tariffs can be implemented will depend on the legal route the President-elect Trump decides to take. The majority of standard tariff-making powers under U.S. law involve procedural steps that could not happen overnight. In other words, while Trump could announce the tariffs on inauguration day, they would require approval form Congress, which could take several months.

That said, Trump could elect to invoke emergency powers allowing for faster implementation. Declaring a state of emergency to implement tariffs, however, would expose the measures to a court challenge.

What can Canada do?

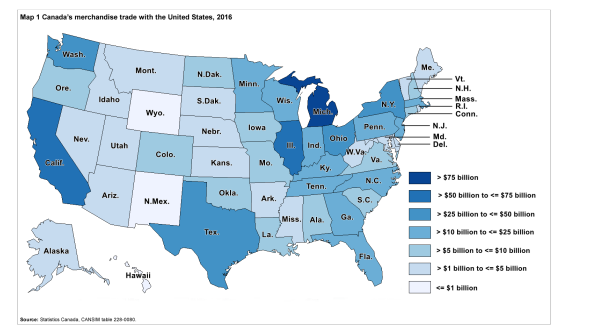

Currently, Canada is the number one export partner of 35 different states5. In fact, for some states, like North Dakota, Canada represents almost 80% of the state’s total goods exports6. On a per-capita basis, Canada buys far more from the U.S. than the U.S. buys from Canada. The question the is: how would these states react to this disruption? The U.S. map below highlights the states which are significant importers of Canadian goods.

Source: Statistics Canada Canada’s merchandise trade with the U.S. by state

Moreover, many of the goods shipped from Canada are of strategic importance to the U.S., such as commodities (oil and metals) as well as motor vehicles. Tariffs on these products would increase the cost of gas and prices for cars – an outcome that could prove widely unpopular.

Currently, the Canadian government is creating a fulsome plan to respond with tariffs targeting American steel products, ceramics (sinks, etc.) and plastics. Ottawa is likely to target products from Republican-leaning states and swing states – where these tariffs could do the most damage to Trump’s credibility with respect to promises of increased prosperity.

As was the case during the first Trump administration, Canadian businesses are also likely to begin lobbying state governments directly, to build awareness of the implications of broad tariffs on consumer prices and competitiveness, in order to negotiate side deals.

Bark or bite?

While the threat of 25% tariffs across the board is indeed alarming, many economists believe that broad tariffs are unlikely to come to fruition, particularly if Canada retaliates. Many believe that the President-elect is merely bluffing and using the threat of tariffs as a bargaining tool to influence the renegotiation of the USMCA, scheduled for 2026.

Trump remains a contentious and unpredictable figure who has a history of using inflammatory rhetoric as a tactic to achieve certain ends. Whether his threats result in action is still unknown.

Sources:

- Western News ‘Expert explainer: Trump’s 25% tariff threat’

- Scotiabank ‘Rules of Thumb for Estimating the Impact of U.S. Tariffs on Canada’

- S. Energy Information Administration (EIA) ‘Canada’s crude oil has an increasingly significant role in U.S. refineries’

- BNN Bloomberg Canada Has Counter-Tariffs Ready If Trump Launches Trade War, Trudeau Says

- CBC News ‘Mind Your Business’ Here we go

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

AI Trends – 2026

20 February 2026