Beyond 60/40: The Case for Private Market Investments in the Modern Balanced Portfolio

The 60/40 portfolio, allocating 60% to equities and 40% to fixed income, has long been a cornerstone of investment strategy, particularly for those seeking a balance between growth and volatility. This approach capitalizes on the historical inverse relationship between stocks and bonds, where bonds often appreciate during equity market downturns, providing a stabilizing effect.

The 60/40 portfolio, allocating 60% to equities and 40% to fixed income, has long been a cornerstone of investment strategy, particularly for those seeking a balance between growth and volatility. This approach capitalizes on the historical inverse relationship between stocks and bonds, where bonds often appreciate during equity market downturns, providing a stabilizing effect.

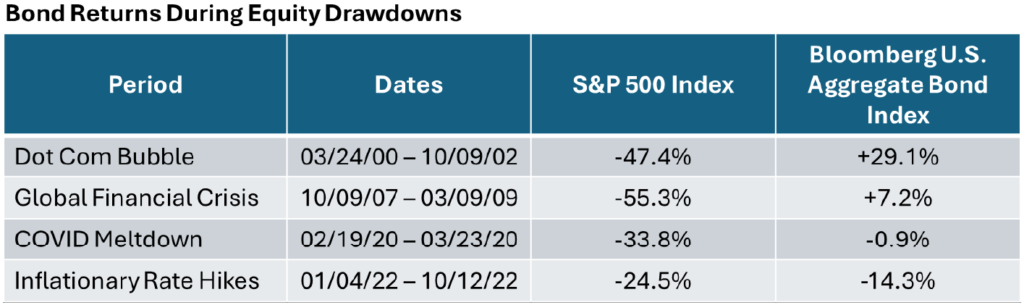

Famously, during the 2008 global financial crisis, when equities were falling, bonds appreciated and acted as a ballast for investor portfolios in volatile markets. Bonds posted a 3% return in contrast to –38% for the S&P 500.1

Historically, this strategy has delivered reliable returns. From 1981 to 2008, a period marked by declining interest rates and stable inflation, the 60/40 portfolio achieved annualized returns exceeding 8%2, comfortably outpacing inflation and meeting the needs of many investors.

The success of the 60/40 portfolio is centered on the belief that diversifying holdings across both public bonds and public equities provides more stable returns than investing in any one asset class. This allocation historically led to a smoother investment experience through lower volatility, as the performance of stocks and bonds tended to rise and fall at different times.

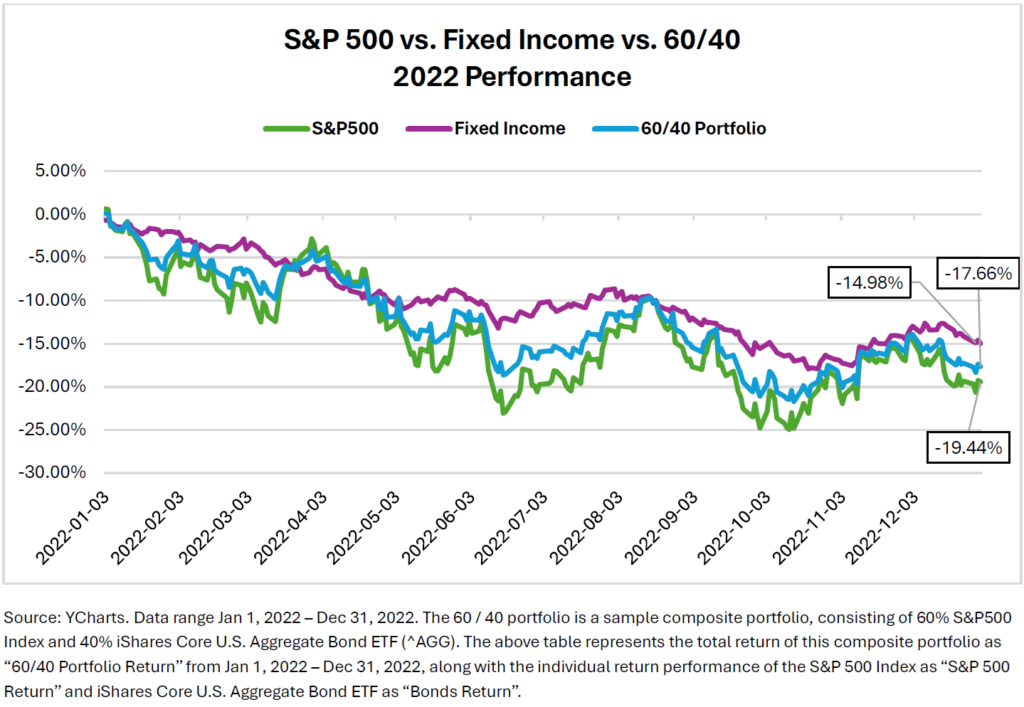

However, the investment landscape is evolving, and the traditional 60/40 portfolio has faced challenges in recent years due to both structural and economic shifts that have permanently altered correlations between traditional asset classes. As a result, the historical negative correlation between equities and bonds is no longer guaranteed. We witnessed this decoupling through the bear market of 2022 when both stocks and bonds suffered negative returns with a positive correlation of over 50%3.

Figure 1

During the post-pandemic period, the global economy experienced high inflationary pressure resulting from significant monetary easing as well as strained economic growth. Under this new paradigm, the 60/40 portfolio significantly underperformed, declining over 17.5%4 (see figure 2) — posting the worst performance since 1937. Moreover, although the 60/40 approach is presumed to smooth performance, the 60/40 portfolio experienced volatility of nearly 16%5 in 2022, as measured by standard deviation.

Figure 2

Why the 60/40 Portfolio Falls Short in Modern Markets

The investment landscape has fundamentally shifted, exposing the vulnerabilities of the traditional 60/40 portfolio. While this strategy thrived in a world of falling interest rates and moderate inflation, today’s economic realities challenge the ability of this approach to deliver the stability and returns investors once relied upon.

- Rising Positive Correlation Between Stocks and Bonds

Historically, stocks and bonds have often moved in opposite directions, allowing bonds to serve as a hedge during equity market downturns. This negative correlation has been a cornerstone of the 60/40 portfolio’s effectiveness. However, in recent years, this relationship has shifted. Notably, in 2022, both asset classes experienced significant losses simultaneously, undermining the traditional diversification strategy.Bonds, traditionally seen as safe-haven assets, have not consistently provided the expected counterbalance during periods of equity volatility. This shift suggests that the diversification benefits of bonds may continue to diminish as the market environment evolves.

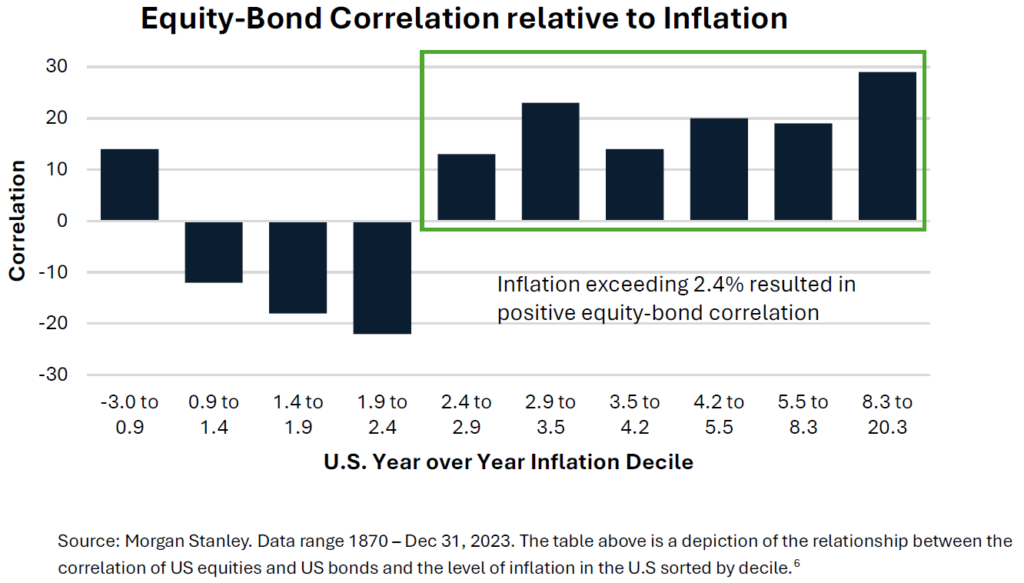

- Inflation

Inflation poses a significant challenge to balanced portfolios. Historically, periods of high inflation have correlated with increased volatility and lower returns for balanced strategies as monetary policy tightening leads to sharp declines in both bonds and equity. As a result, higher inflation leads to stronger positive correlations between bonds and equity, particularly on the downside. For example, during the inflationary period from 1960 to 1979, when inflation exceeded 2.4%, stock and bonds became positively correlated with correlations as high as +30%.

Figure 3

Instead of providing smoother performance through ‘diversification’, the global market portfolio, the 60/40 portfolio significantly unperformed, realizing a compounded real return of around 3% per year. In contrast, during the more stable inflation period from 1980 to 2018, the 60/40 portfolio realized a compounded annual return of 6% per year.7Bonds, especially those with fixed coupons, lose value in real terms during inflationary periods, while equities often struggle with rising costs and margin pressures. High inflation also drives the positive correlation between stocks and bonds higher, reducing the diversification benefit for portfolios and eroding real returns. This combination creates a “double bind,” where neither asset class effectively mitigates risk or generates sufficient returns.

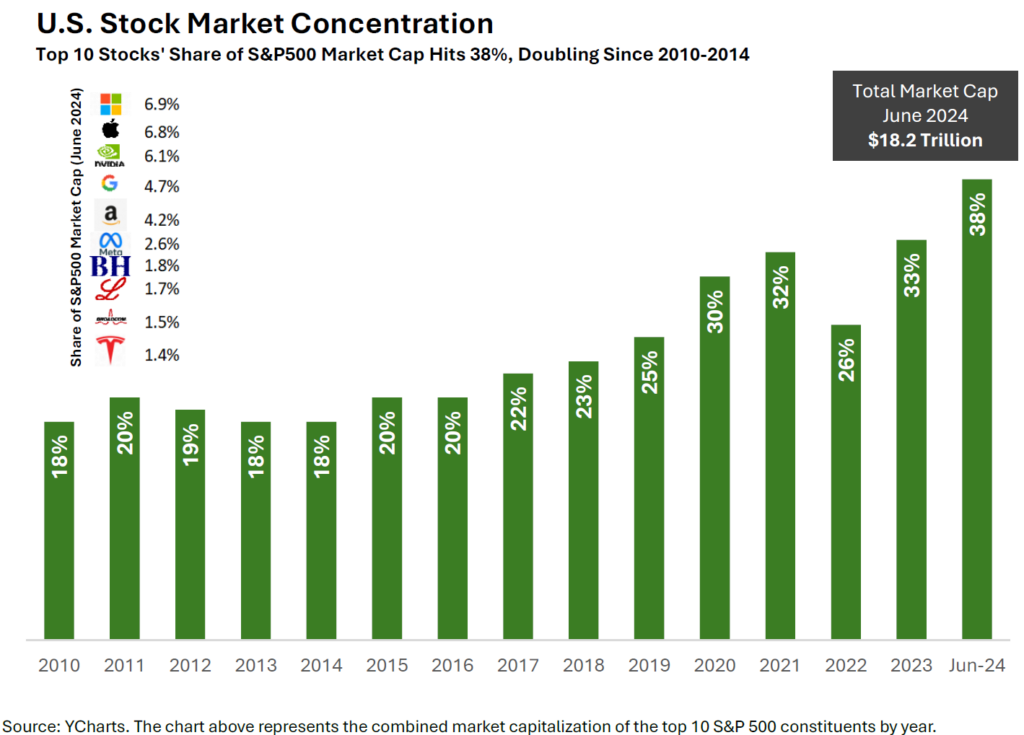

- Concentration and Volatility

One of the reasons the 60/40 portfolio was so popular in days past, is that it provided a foolproof method for diversification. Often relying on an index-like approach when it came to both the 60 and the 40.

One of the challenges in today’s environment, particularly with equity investing, is that equity markets have become increasingly concentrated, with no signs of slowing.

By the middle of 2024, the top ten companies in the S&P 500 represented 38% of the index, with nearly all those names concentrated in the tech sector. This means that the diversification benefit is diminishing within the public equity asset class itself and leading to greater volatility, as the factors driving investment returns continue to consolidate.

A Better Way Forward: Diversification Through Private Asset Classes

As the challenges of the traditional 60/40 portfolio become more apparent, investors are increasingly turning to private asset classes to enhance diversification, reduce volatility, and improve returns. Ultimately, investors cannot trust stocks and bonds on their own to do the job of providing income, growth and downside protection anymore.

- What Are Private Asset Classes?

Private investments go beyond traditional public markets, encompassing privately held assets and strategies that often provide higher returns and lower correlations to equities and fixed income. Key categories include:

Private Equity: Investments in private companies, offering the potential for higher returns through active management in day-to-day business decisions and growth opportunities.

Private Credit: Loans to businesses or real estate ventures, which provide higher yields than traditional fixed income through bespoke lending solutions.

Private Real Estate: Direct investments in properties or real estate funds, generating returns through income and long-term appreciation.

- Benefits of Private Market Investments in Modern Portfolios

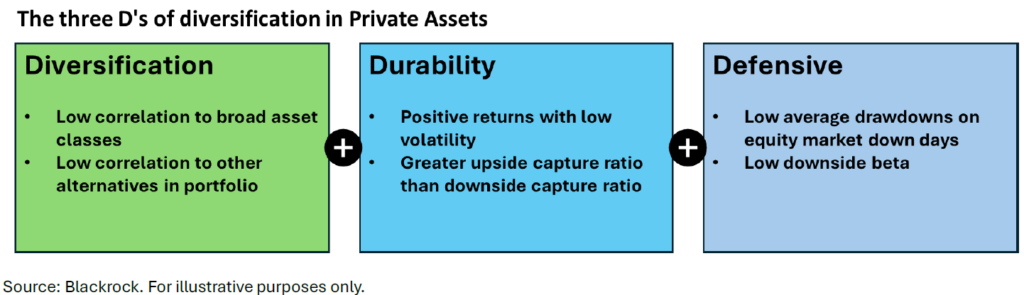

Enhanced Diversification: As touched on earlier, public stocks and bonds are more highly correlated today than they have been in the past. Private asset classes offer lower correlations with traditional asset classes, which helps smooth returns and mitigate volatility.

Improved Return Profile: Private markets offer a unique advantage: the illiquidity premium. Investors are compensated for holding assets that are not immediately tradable, which can result in higher long-term returns compared to public markets.Downside Protection: Private assets are insulated from short-term market price fluctuations, offering stability during times of public market turmoil. Additionally, active management in private markets, such as hands-on operational improvements in private equity or underwriting in private credit, can provide an additional layer of risk control.

- Striking the Right Balance

The challenges faced by the 60/40 portfolio underscore the need for a more resilient approach to portfolio construction. Incorporating private assets into a modern balanced portfolio not only addresses these challenges but also creates opportunities for enhanced returns and reduced risk. By embracing pension-style asset classes such as private equity, private credit, private real estate, and Infrastructure, investors can unlock a range of benefits that traditional asset classes alone can no longer deliver. So what is the right mix then?

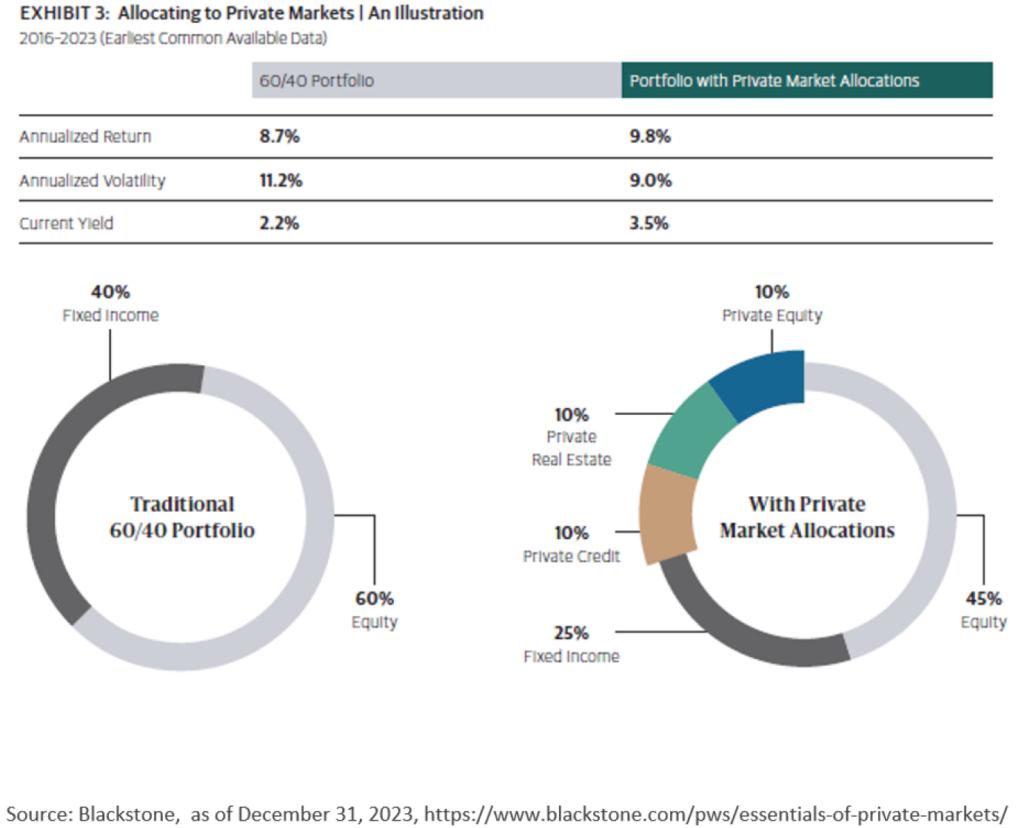

The answer is…it depends! Depending on prevailing market conditions, the optimal mix between stocks, bonds, private real estate, private credit, private equity, and other asset classes will vary. But even with a sample fixed allocation of 45% stocks, 25% bonds, 10% private debt, 10% private equity, and 10% private real estate results in both the risk and return profile improving greatly.

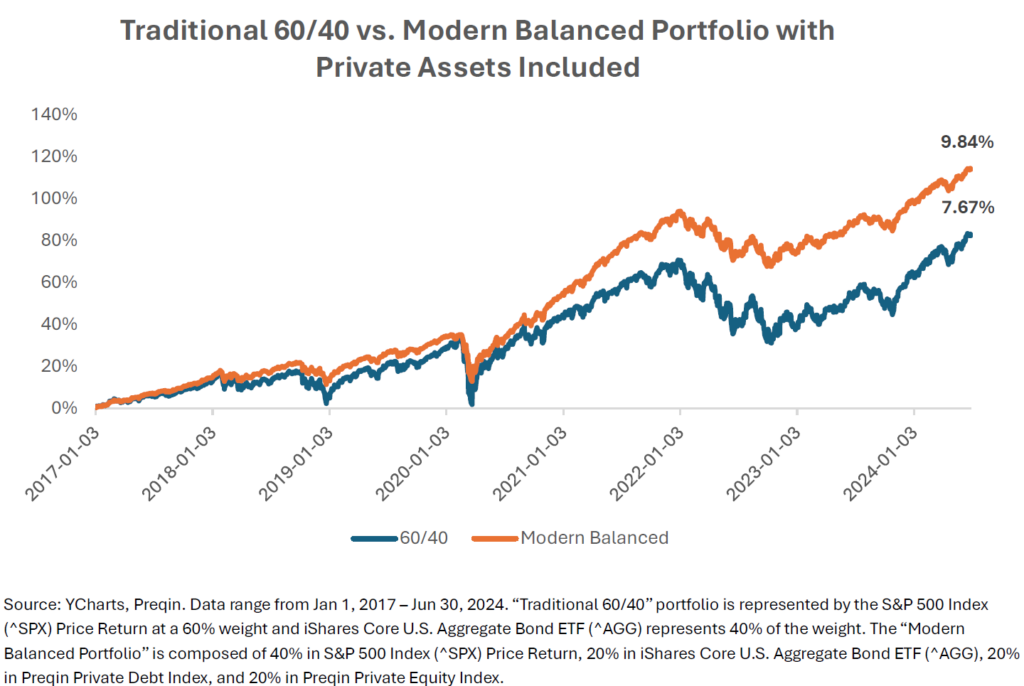

Figure 5 below shows another example with a slightly different mix with a similar result: lower volatility, better returns, and a higher yield for clients. Investors not incorporating private asset classes into their portfolios are simply not investing as optimally as they should be.

Figure 5

Conclusion

The only certainty in the investment industry is uncertainty. 2025 is off to a volatile start with record high public equity valuations, tariff negotiations, and a very fragile inflation backdrop. Including private asset classes will be more important now than ever in protecting against downside risk, and ensuring investors are positioned prudently.

Incorporating private assets into a modern portfolio is no longer optional—it’s essential. The traditional 60/40 portfolio, while historically successful, is ill-equipped to navigate the complexities of today’s markets. By embracing private equity, private credit, and private real estate, investors can enhance returns, reduce volatility, and achieve a more resilient financial future. This evolution not only safeguards against the challenges of modern markets but also positions portfolios to thrive in a rapidly changing economic environment. The future of investing lies in embracing a broader toolkit, and private assets are at the heart of this transformation.

A Note on Risks:

While providing various important benefits, private investments also carry some additional risks, which could be different from the risks associated with investing in public markets. It is important for investors to work with financial professionals who understand private markets and are able to make active investment decisions.

- • Market risk – Private market investors may experience differentiated market risk compared to public market investments. Private companies are subject to different disclosure requirements and are sensitive to a variety of factors that may impact valuations differently than public markets.

- • Liquidity risk – Private markets funds have varying liquidity profiles, often allowing liquidity on a monthly, quarterly, or less frequent basis. It is important for investors to understand the liquidity characteristics of private market investments before investing.

Sources

1 YCharts

2 Yahoo Finance, eVestment

3 Alternative Diversifiers: Rethinking diversification in investment portfolios | Russell Investments. (n.d.). https://russellinvestments.com/us/blog/alternative-diversifiers

4 YCharts

5 YCharts

6 Morgan Stanley Investment Management. (n.d.). The big picture: Return of the 60/40. Retrieved from https://www.morganstanley.com/im/publication/insights/articles/article_bigpicturereturnofthe6040_ltr.pdf

7 Doeswijk, R. Q., Lam, T., & Swinkels, L. (2019). Historical returns of the market portfolio. Review of Asset Pricing Studies, Forthcoming. Available at SSRN: https://ssrn.com/abstract=2978509 or http://dx.doi.org/10.2139/ssrn.2978509

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, David Ferreira, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q1 2025

10 April 2025