Tariff Table Tennis Continues

- • The situation is evolving quickly: Tariff negotiations continue to evolve as Canada, Mexico and others continue to negotiate behind closed doors to prevent an all out trade war. Tariffs on some goods, including USMCA-compliant goods and imports from the big three automakers have been put on pause as part of these negotiations.

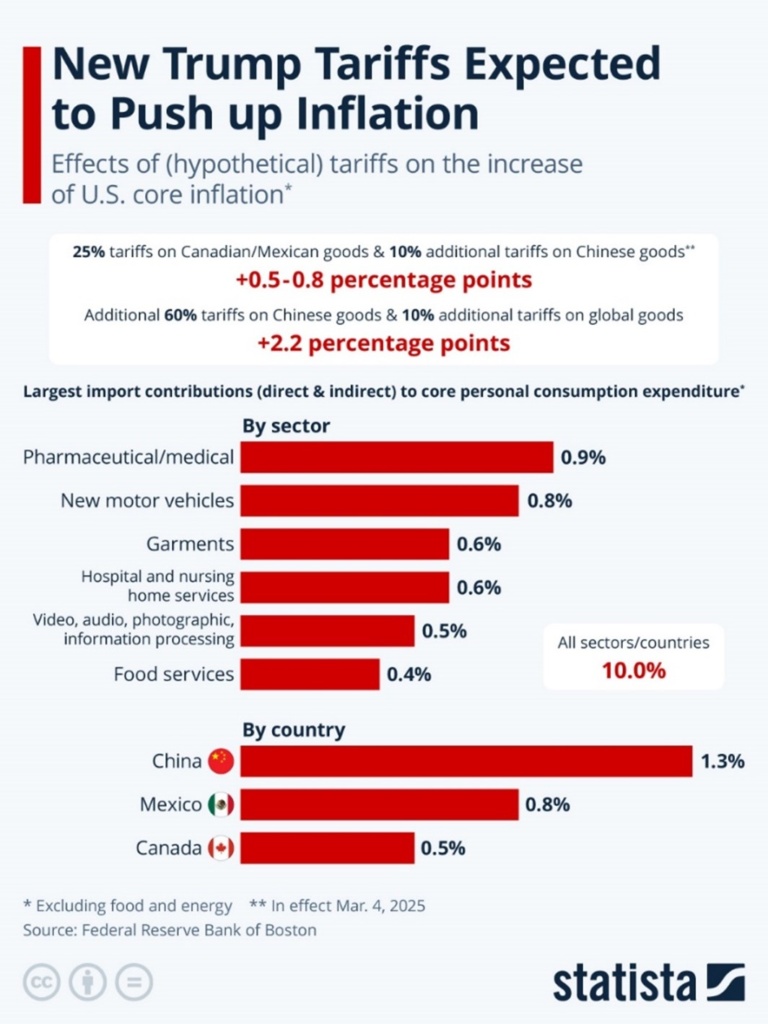

- • New tariffs implemented: On March 4, the U.S. imposed broad 25% tariffs on imports from Canada and Mexico (with a 10% tariff specifically on Canadian energy exports). In response, Canada introduced 25% counter-tariffs on U.S. goods, starting with $30 billion in imports effective immediately, with plans to expand up to $155 billion worth if U.S. tariffs persist. Other countries are also responding (China added 15% tariffs on select U.S. goods), signaling rising global trade tensions.

- • Market volatility: Trade policy is expected to remain in the headlines, which may lead to continued market volatility in the near term. Equity markets reacted negatively to the tariff announcements, reflecting investor anxiety about a potential trade war.

- • Economic impact – manageable, but notable: The direct economic impact of these tariffs on Canada, while significant for affected industries, should be manageable at a macro level. The targeted steel and aluminum sector, for example, makes up only about 0.5% of Canada’s GDP. Tariffs will likely cause a one-time price increase on affected goods, but this inflation bump is expected to be limited (not severe enough to derail economic growth or force interest rate hikes by central banks). The broader concern is that prolonged trade uncertainty could weigh on business confidence and investment if tensions persist.

Overview of the new tariffs

- • U.S. tariff actions: President Trump invoked emergency trade powers to levy 25% tariffs on most imports from Canada and Mexico effective March 4. The U.S. also increased tariffs on Chinese goods by an extra 10%, doubling tariffs on many Chinese imports.

- • Canadian Response: The Canadian government reacted swiftly with a “dollar-for-dollar” counter-tariff strategy. It announced 25% tariffs on U.S. imports worth up to $155 billion, implemented in phases. These countermeasures aim to pressure the U.S. to reverse its “unjustified tariffs” while attempting to protect Canadian interests. Other trading partners are following suit: China imposed 15% tariffs on certain U.S. goods, and Mexico has warned it will announce retaliatory measures by mid-March.

Economic and market impact to Canadian economy

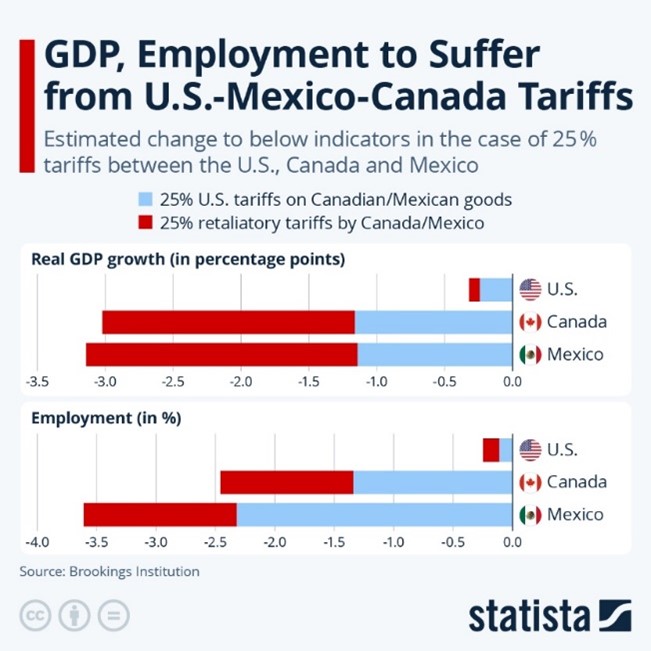

- • GDP impact likely modest – affected sectors (steel, aluminum, consumer goods) are a small share of total trade, with steel and aluminum exports making up only 3% of Canada’s total exports (~$24B CAD).

- • Canada’s counter-tariffs target ~$155B USD of U.S. goods, impacting 3% of Canadian imports—raising prices but not enough to drive severe inflation or economic disruption.

- • Lower debt levels leave Canada in a good position; relative to China and Mexico, Canada may be better positioned. Randall Bartlett, deputy chief economist of Desjardins notes, “The federal government has a much lower level of debt as a share of GDP than the United States and many other advanced economies”.

- • Trade dependence increases risk; with exports/imports making up 67% of GDP, Canada is more vulnerable than the U.S. (~25%). Key industries like auto manufacturing (Ontario) and resources (Western Canada) could see slower growth or job losses if tariffs persist.

Market reaction

- • Markets turned volatile after the March 4 tariffs, with declines in industrials, autos and materials, while investors moved into bonds, pushing yields lower.

- • The Canadian dollar weakened slightly against USD, reflecting concerns over economic drag, though movements remain within historical ranges.

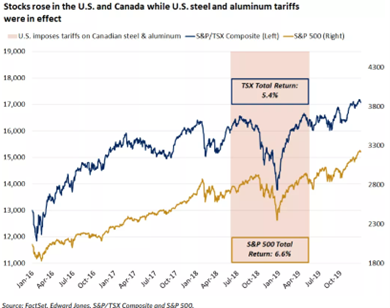

- • Short-term volatility is expected; past tariff disputes (e.g., 2018) triggered similar sell-offs, but markets rebounded once tensions eased. Headline-driven swings are likely in the near term.

What about the Canadian Dollar?

- • Trade alone doesn’t dictate the loonie – While tariffs and trade uncertainty can drive short-term weakness, broader macro factors like commodity prices, interest rates, and global growth play a bigger role in long-term currency movements.

- • Short-term dips, but history shows rebounds – The CAD typically falls when trade tensions rise but has recovered once uncertainties clear, as seen in past disputes like the 2018 trade war and 2002 steel tariffs.

- • Trade tensions weaken the loonie – Tariffs increase uncertainty, pushing CAD lower as investors anticipate economic damage, weaker exports, and possible BoC rate cuts.

- • Historical pattern: during the 2018 trade war, CAD fell on tariff threats but rebounded when the USMCA deal was reached. It never fully recovered, however, due to lingering economic headwinds.

- • 2002 steel tariffs example – CAD was already weak due to low commodity prices and a strong USD but surged later as oil prices and Canada’s trade balance improved. Tariffs alone don’t dictate CAD trends—broader macro factors matter.

Key takeaways

- • Short-term volatility, long-term resilience: Markets often react with knee-jerk selloffs to tariff news, but declines are typically short-lived. The 2025 tariffs triggered a stock drop, much like past trade disputes, but history shows markets rebound once uncertainty clears.

- • Sell-offs often reverse when tensions ease. In 2018–2019, markets declined sharply during the U.S.-China/Canada trade war. The S&P 500 fell ~4% in 2018, then surged 31% in 2019 once a truce was reached. Chinese stocks dropped 30% before rebounding 36%. This highlights how fear-driven selloffs often reverse when tensions ease.

- • Guidance for investors: Avoid panic selling; history shows that staying invested and diversified is the best approach. Tariff-driven dips can even create buying opportunities for quality companies. Patience has paid off in past trade disputes, with markets recovering once agreements are reached.

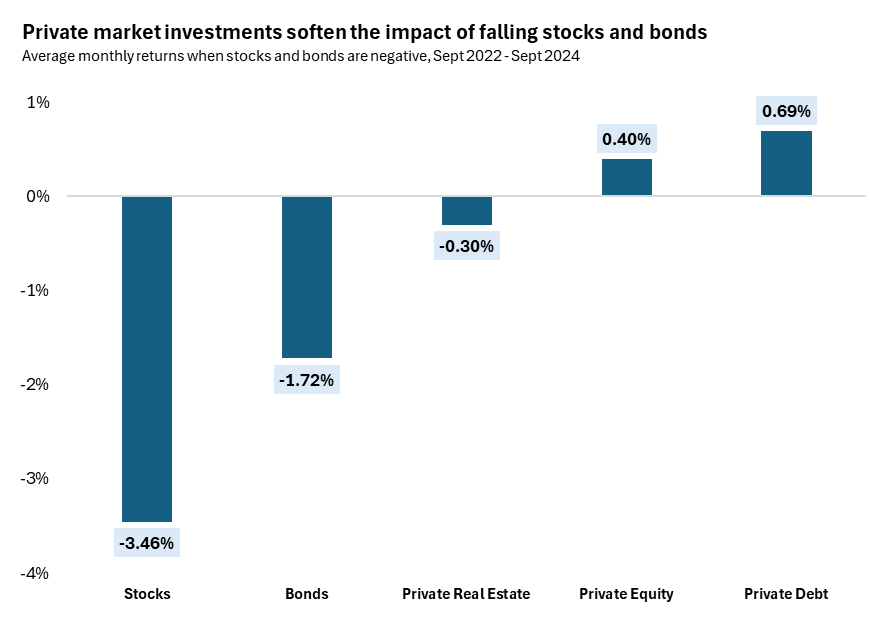

Private assets as a portfolio ballast

- • Private assets provide stability in volatile markets. Unlike stocks and bonds, private credit, private equity, real estate, and infrastructure are less sensitive to daily market swings, making them valuable in uncertain trade environments.

- • Lower correlation, smoother returns. These assets don’t trade on headlines, meaning they avoid the short-term volatility that tariff-driven markets experience. Their long-term, cash-flow-focused nature provides resilience.

- • Consistent income and diversification. Private assets generate steady cash flow through loans, leases, or contracts, helping offset public market downturns. Their low correlation to stocks and bonds enhances overall portfolio diversification.

- • Protection from short-term shocks. During past trade disputes, private markets remained more stable than public equities, as valuations are not driven by daily sentiment but by underlying fundamentals.

Conclusion – This Too Shall Pass

- • Avoid reactionary moves. Tariffs and trade disputes create short-term noise, but history shows that markets recover once uncertainty clears. Selling in panic often leads to missed opportunities when conditions improve.

- • Stay focused on long-term goals. Investing is about discipline and patience, not reacting to headlines. A well-diversified portfolio built for long-term objectives will withstand temporary market disruptions.

- • Time in the market beats timing the market. Investors who try to jump in and out based on short-term news risk missing the best recovery periods. Staying invested has historically delivered better long-term results than attempting to time volatility.

- • Volatility creates opportunity. Periods of uncertainty often lead to attractive entry points for quality assets. Rather than fearing downturns, investors should view them as chances to rebalance, diversify, and position for future growth.

- • Private assets can provide stability. For those looking to mitigate volatility, private investments offer lower correlation to public markets and consistent income, helping investors stay the course during turbulent times.

The bottom line: Stick to your plan, stay invested, and trust in long-term market resilience—history has shown that those who do are rewarded over time.

Disclaimer

I, David Ferreira, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc

Fasten your Seatbelt

8 April 2025