Navigating Current Market Turmoil

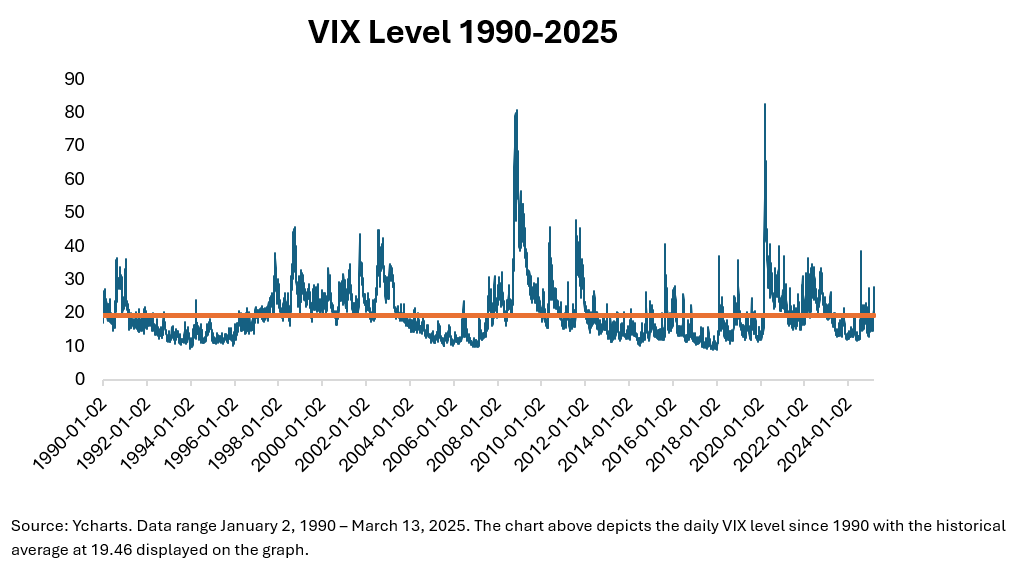

Recent market swings have investors glued to the headlines, with both Canadian and Global markets experiencing drawdowns, with some entering correction territory (a drop of over 10% from its recent peak). The CBOE Volatility Index (VIX) – often called the “fear index” – has spiked into the mid-20s. So, what has been driving the recent market activity?

- Inflation concerns: Lingering price pressures have become a key worry. Tariff-related cost increases are filtering through to consumers, prompting some analysts to raise inflation forecasts – for example, RBC recently revised its 2025 U.S. core inflation expectation up to ~2.9% (from 2.6% prior) amid the tariff impact. This has materialized as Canadian inflation print was reported above expectations for the month of February. Higher inflation can erode corporate profits and consumer spending power, keeping investors on edge about potential Federal Reserve responses.

- Trade policy changes: Uncertainty around global trade has been a major volatility catalyst. The U.S. administration’s back-and-forth tariff moves against key trading partners (such as new tariffs on imports from Canada, China, and Mexico) have dampened investor appetite for risk. These trade tensions are fanning fears of rising input costs (adding to inflation) and supply chain disruptions. The lack of clarity on trade policy has effectively become an overhang on market sentiment.

- Economic slowdown fears: Signs of cooling growth are also weighing on markets. In fact, some high-profile forecasters have downgraded their GDP outlooks – Goldman Sachs recently cut its 2025 U.S. GDP growth forecast to 1.7% (from a prior 2.4%), largely due to the expected drag from tariffs and policy uncertainty. Such revisions fuel concern that the economy could lose momentum, or even tip into a mild recession. Slower growth expectations, combined with the prospect of tighter financial conditions, have made investors more skittish about equities.

Despite these headwinds, it’s important to note that the current volatility, while noticeable, appears to reflect a typical late-cycle market adjustment rather than a sign of crisis. Markets are digesting new information on inflation and policy, and repricing risk accordingly. The silver lining is that this kind of volatility also signals that risks are being recognized and priced in – a process that can set the stage for more stable gains once uncertainties begin to clear.

Historical Perspective on Volatility: Patience is Paramount

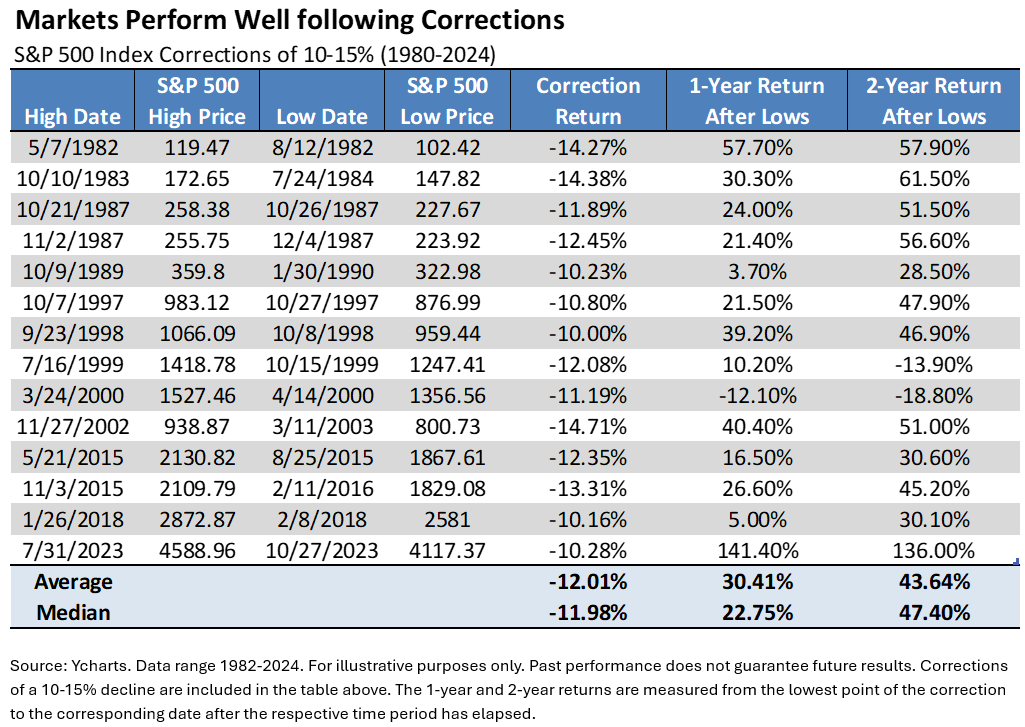

Volatility is a natural part of investing, and history shows that market corrections are relatively common – and often short-lived. For example, The S&P 500 has experienced 14 corrections since 1982, averaging declines of 12%. These corrections typically recover within four months, showing that volatility is not a permanent condition. When looking at these examples, we can see that the average 1-year return after the low was over 30%. That number jump to over 43% after 2 years.

Figure 1

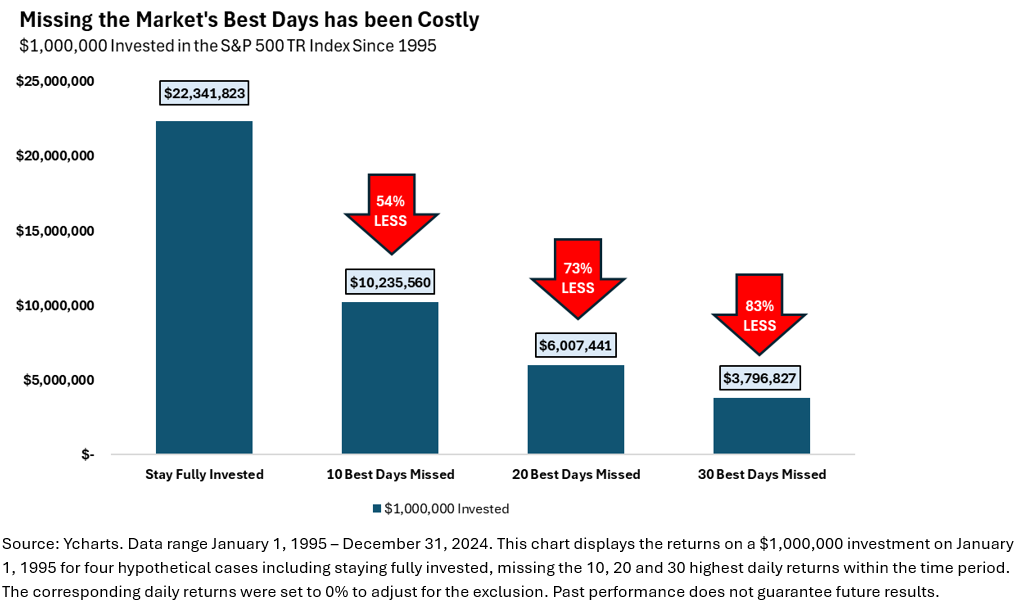

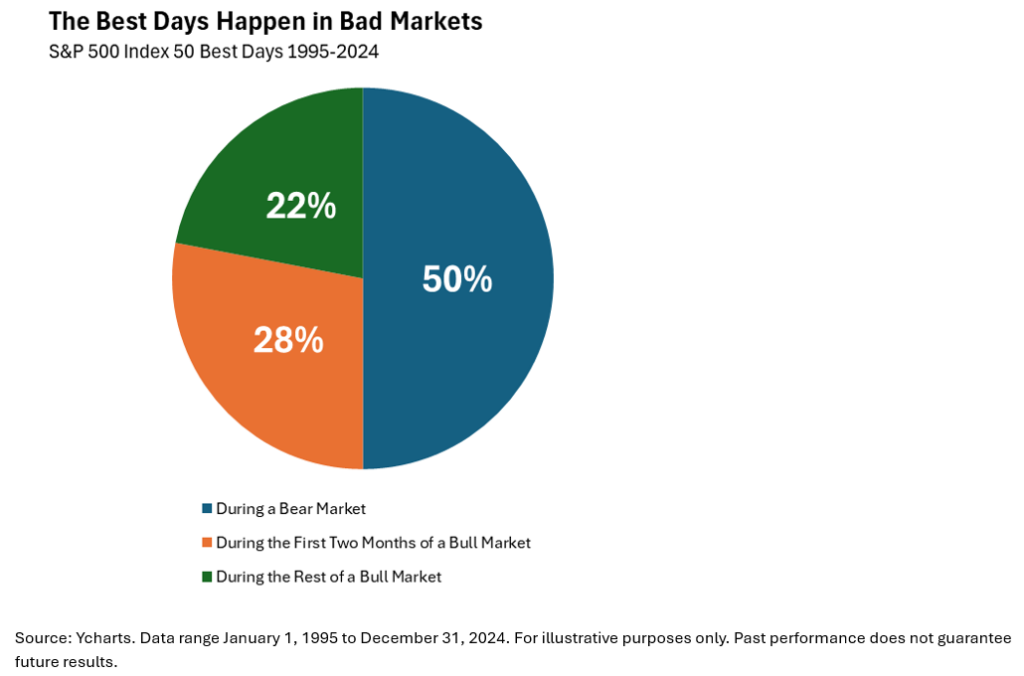

It’s about Time in the Markets, not Timing the Markets: The scale and duration of growth phases have greatly outweighed the scale and duration of the downturns. This is why experienced investors emphasize “time in the market” over “timing the market.” Trying to jump in and out to avoid volatility often backfires – many of the market’s best days occur amidst the worst times. In fact, a majority of the top 10 single-day gains in the market over the past 20 years took place during either the 2008 crisis or the 2020 downturn. Missing those big rebound days can deeply dent long-term returns. For example, an investor who stayed fully invested from 2003–2022 earned close to a 9.8% annual return, whereas missing just the 10 best days in that period would have cut their return nearly in half (to around 5.6% annually).

Figure 2

Figure 3

This underscores that patiently riding out volatility is often wiser than attempting to time the perfect exit and re-entry. History teaches that volatility comes and goes, but the long-term trend of the market has been upward. Investors who maintain a long-term perspective and disciplined approach have typically been rewarded over time, despite the bumps along the way.

Although volatility may dominate headlines right now, it remains well within historical norms: the CBOE Volatility Index (VIX) is currently around the mid-20s, modestly above its long-term average of roughly 19, yet far below the extreme peaks near 80 witnessed during past crises like the 2008 Great Financial Crisis, and early 2020’s pandemic-driven panic. This moderate, rather than elevated, reading signals that markets are pricing in uncertainty—driven by factors like inflation worries and shifting trade policies—but not the fear that typically precedes severe downturns. Consequently, while investors should stay mindful of short-term fluctuations, today’s volatility profile more closely resembles a normal “market adjustment” phase than the onset of a major crisis.

Figure 4

Mitigating Volatility with Private Market Investments

One-way investors can dampen the impact of public market volatility is by broadening their portfolios into private markets.

Private markets offer stability in times of volatility

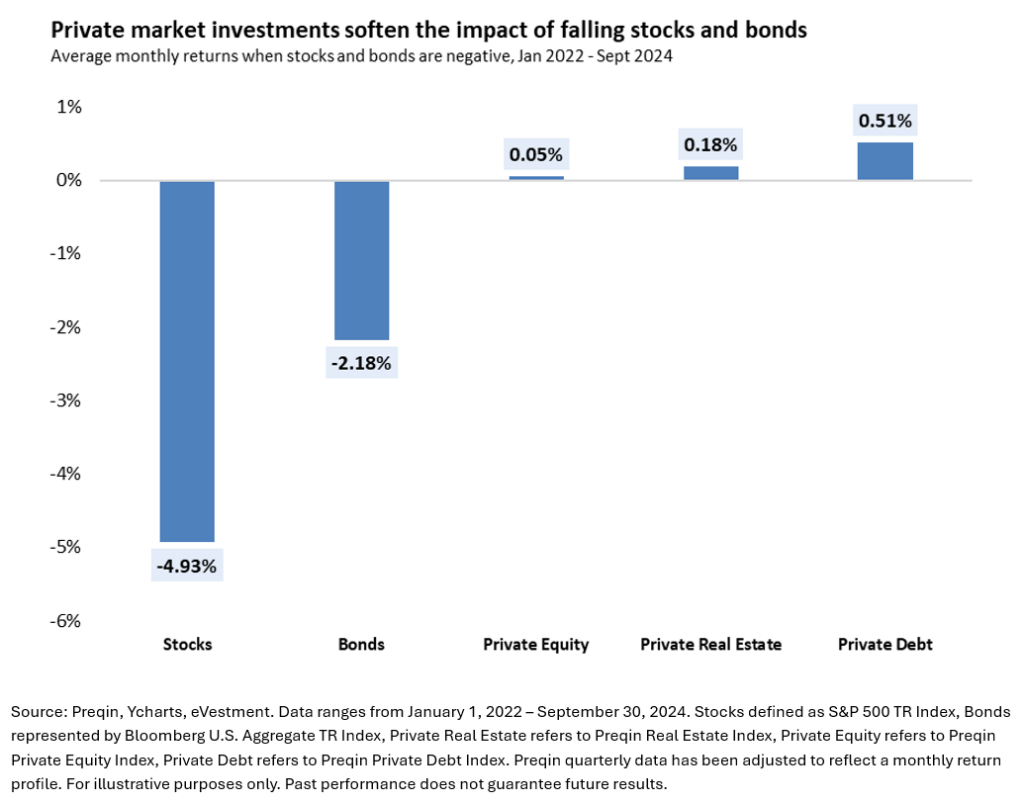

Private market investments have further underscored the value of diversification by offering a measure of stability during public market downturns. For instance, in the same period that saw heightened volatility in listed equities, from January 2022 to September 2024, private equity delivered a return of +0.05%, private real estate gained +0.18%, and private debt rose +0.51%. Unlike their publicly traded counterparts—where prices can swing sharply day-to-day—these private holdings often rely on long-term fundamentals and are less prone to rapid sentiment-driven selloffs. As a result, they can help soften the overall impact of turbulent public markets, reinforcing their role as a valuable component of a well-rounded investment strategy.

Figure 5

Active Management During Turbulent Markets

In highly volatile environments, dynamic and proactive decision-making can give active managers an edge over passive index strategies. For instance, during the rapid market shifts of 2022—marked by steep interest-rate hikes—many active equity funds that shifted away from growth stocks and into undervalued or defensive names successfully mitigated losses, whereas broad benchmarks like the S&P 500 fell more sharply. Likewise, active bond managers who shortened duration or sought higher-yielding credit instruments frequently outpaced standard bond indexes, demonstrating their ability to adapt quickly and preserve capital under stress.

This flexibility to respond in real time, exploit mispriced securities, and allocate tactically can translate into better risk-adjusted performance when markets are in flux. Especially when high dispersion causes certain segments to plunge while others remain resilient, well-positioned active strategies can capitalize on the imbalances that blanket index funds cannot avoid. As a result, investors willing to commit to skilled, research-driven teams may find that active management not only buffers against downturns but also captures opportunities, ultimately outperforming passive approaches in times of heightened uncertainty.

So What Now?

Market volatility and resulting swings in investment values, while causing investor anxiety, are inevitable parts of investing. The recent bout of volatility – driven by inflation worries, shifting trade policies, and growth jitters – is a reminder that markets won’t go up in a straight line. However, it’s also not a cause for alarm if you’re prepared. History shows that downturns are usually temporary and followed by recoveries; patience and discipline are often rewarded.

Investors are encouraged to stay the course rather than time the market’s ups and downs Sticking to a well-thought-out plan allows the powerful long-term trend of growth to work in your favor. One key part of that plan is prudent asset allocation. By spreading investments across different asset classes – including an allocation to private markets alongside public stocks and bonds – investors can build a more resilient portfolio to navigate turbulence. Private assets, in particular, can act as stabilizers, providing diversification benefits and steadying influences when public markets are volatile

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, David Ferreira, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q1 2025

10 April 2025