Fasten your Seatbelt

Executive Summary

- • Following Trump’s announcement to impose steep tariffs across the world, global stock markets posted record losses and recessionary fears returned

- • This strategy has been designed not as a tool of reciprocity but more as a blunt force instrument to eradicate all trade deficits between the U.S. and foreign countries

- • Markets are waiting to see if Trump will be open to negotiation

- • Under the CUSMA trade agreement, Canada has been largely spared from these reciprocal tariffs – however, slowing growth and increased volatility will become the norm

- • Investors are encouraged to stay the course rather than time the market’s ups and downs

The New Status Quo

On April 2nd, President Trump announced sweeping new tariffs targeting countries around the world, effectively taking a sledgehammer to global trade. Trump’s tariff assault hit over 180 countries with penalties ranging from 1% to 40% layered onto a 10% universal tariff on all imports in the U.S. The scope of these tariffs has brought the global average effective tariff rate to 24%, even higher than that seen in the 1930s.

While Canada and Mexico were spared from Trump’s “reciprocal” tariffs, the 10% tariff on energy and the 25% tariff on steel and aluminum still stand. According to economists at TD Bank, the effective tariff rate Canada now faces from the U.S. is roughly 10%, up from less than 2% before Trump took office. However, goods from Canada that are compliant with the CUSMA trade agreement will continue to trade tariff-free.

The Retaliation Fallacy

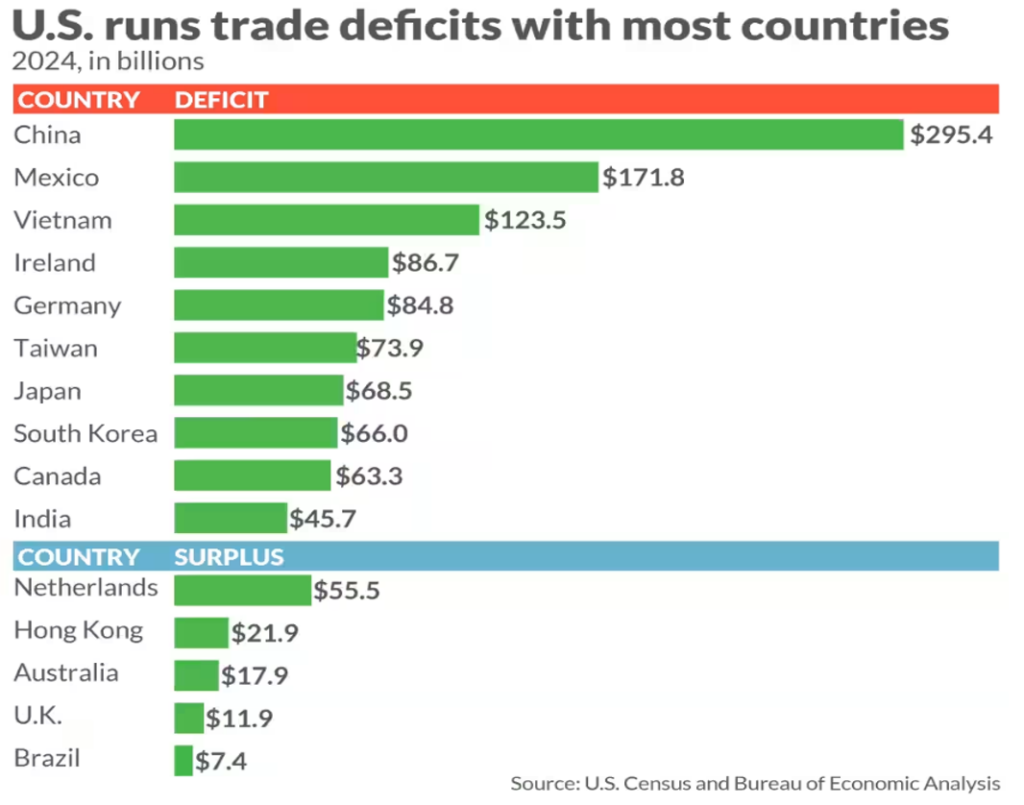

While the White House condemns trade deficits as “subsidies” and an example of how the world takes advantage of America, these deficits are in fact a historical norm for the U.S. In fact. The U.S. has been running consistent trade deficits since 1976 due to high imports of oil and consumer products.

Figure 1

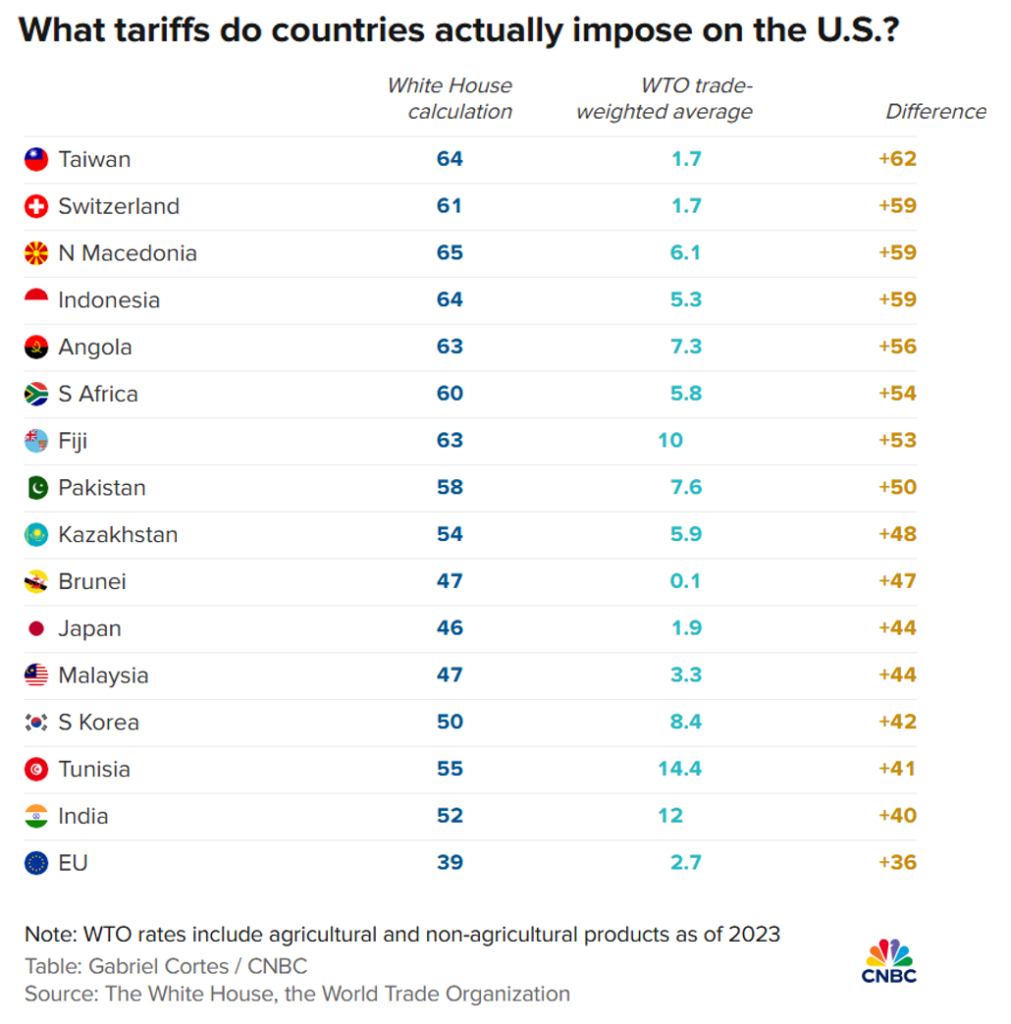

While the Trump administration has claimed the recently imposed tariffs are “reciprocal”, these levies do not actually match tariff rates charged on U.S. imports by these countries. The formula used is simply the country’s trade deficit with the U.S., divided by its exports, then divided by two. Economists agree that this formula is flawed, resulting in inflated tariff rates. There is nothing “reciprocal” about imposing a 10% tariff on the UK when it has a tariff rate of 0.7% on U.S. imports.

Not even uninhabited islands have been spared. Populated primarily by penguins, the McDonald Islands, an Australian territory, will now be facing a 10% tariff!

Ultimately, this trade strategy is not to match tariff rates; instead, the policy appears to be attempting to eliminate the bilateral U.S. trade deficit with every country.

Figure 2

Market Impacts

The market reaction was quick and severe, as global equities, the U.S. dollar and oil all posted staggering losses. The major indexes posted their biggest weekly declines since the early days of the COVID pandemic in March 2020, with the S&P 500 and Nasdaq dropping 9.1% and 10%, respectively, for the week.

U.S. Treasury yields continued to decline Friday, with 10-year Treasury yield falling below 4% as investors flooded into bonds for safety on fears of a global recession. The U.S. dollar has also come under significant pressure. While Wall Street originally assumed that Trump’s tariff plans would boost the U.S. dollar, the markets could not anticipate the magnitude of what Trump intended. Concerns about an impending recession have now overwhelmed any positive benefit for the greenback.

The Fed’s next move

Federal Reserve Chair Jerome Powell said on Friday that he expects Trump’s tariffs to raise inflation and curtail growth, noting that the central bank faces a “highly uncertain outlook” due to the scope of tariffs announced this week. Recent economic data suggests stronger fundamentals in the U.S. but many of these are lagging indicators. Following Trumps’s announcement, JP Morgan changed its expectations for a recession from 40% to 60%.

A more pessimistic outlook is likely to put increasing pressure on the Fed to cut. The U.S. is now on the brink of stagflation as the economy slows and tariffs re-ignite inflation. This created quite the predicament for the Federal Reserve – to cut or not to cut? Instead, the U.S. is likely to pivot to fiscal policy and introduce more tax cuts – which means even higher federal deficits.

Will Trump Negotiate?

With the exception of China who retaliated immediately, most targeted nations have held back and are looking to negotiate. Over the weekend, the U.S. administration claimed more than 50 countries had reached out to negotiate the sweeping tariffs, including India, Israel, and Vietnam.

U.S. officials continue to insist that the tariffs are ‘here to stay’ and Trump’s top trade adviser Peter Navarro has suggested countries will have to make additional concessions beyond lowering tariffs on U.S. goods to gain a reprieve. If negotiation is unsuccessful, we can expect more retaliation.

The backlash among Americans has already started, and Trump is likely to lose significant political points to the extent that the economic pain will be felt immediately while any possible gains from a restructured economy will take years. Ultimately, our view is that the path is not sustainable and there will be a reckoning. While Trump’s cabinet stands behind him, the overwhelming consensus among business executives and economists is that this strategy is a mistake.

The Yale Budget Lab estimates that the Trump administration’s tariffs would cost the average household $3,800 in higher prices this year and push clothing prices 17% higher. Further, the Home Furnishing Association predicted tariffs will increase prices on furniture and household goods between 10% and 46%.

For example, countries like Vietnam (hit with 46% tariffs), Indonesia (hit with 32% tariffs) and China (with tariffs as high as 79%) are the top sources of U.S. shoe imports, with Nike manufacturing about half its shoes and one-third of its clothes in Vietnam.

Since the 19th century, economists have promoted the benefits of free trade and in particular, the principle of comparative advantage, where all nations gain by specializing in goods they produce most efficiently and trading with others. At its core, trade is not about competition as it is about co-operation where each nation contributes to a global enterprise in wealth creation.

Implications for Canada

By providing a reprieve to Canada while bringing tariffs onto other global trading partners, Trump may have actually put Canada at a competitive advantage. It appears that U.S. business leaders might have been successful in pressuring Trump to recognize Canada’s critical importance to the U.S. economy. As well, Canada’s automotive sector is better placed than other countries due to the integrated nature of our supply chain.

While retaliation may feel warranted, tit-for-tat trade measures can end up hurting Canada’s economy more than they help. Unfortunately, Canada is ultimately too small to meaningfully move the needle on economic activity in the U.S. Canada needs to focus on what will actually make our economy stronger.

So, What Now?

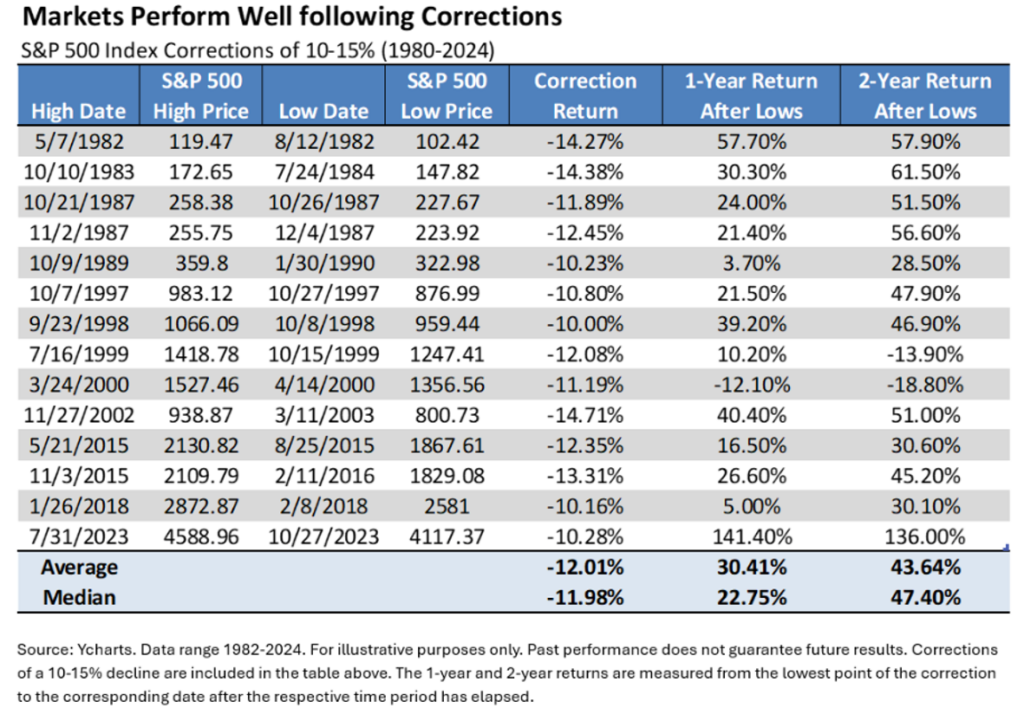

Sharp, sudden market declines can be alarming, prompting many investors to reduce their stock holdings, or pull out of the market. As history has shown, financial markets always recover from market shocks, and ultimately will post strong long-term gains. Selling off investments during a crisis only succeeds in locking in losses while missing out on the inevitable rebound. As we know, markets don’t move in a straight line and investors who stay invested in the market in the long run are always rewarded.

Figure 3

During these times, active managers can create significant value providing an edge over passive index strategies. As well, prudent asset allocation can significantly temper volatility. By spreading investments across different asset classes – including an allocation to private markets alongside public stocks and bonds – investors can build a more resilient portfolio to navigate turbulence.

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Market and Economic Insights – Q1 2025

10 April 2025