The Bait and Switch - Tariffs are Back

Moving in Circles: Tariffs Return

- • Following a month’s reprieve, US President Donald Trump declared yesterday that the 25% tariffs on all goods from Mexico and Canada would proceed

- • Citing a national emergency posed by the inflow of illegal aliens and drugs, Trump stated there is “no room left for Mexico or Canada” to negotiate

- • Conveniently, this argument allows Trump to employ presidential executive powers to implement tariffs without the approval of Congress

- • However, data released by the US Customs and Border Protection earlier this month indicates the opposite – the report in fact indicates a significant decrease in seizures of fentanyl coming from Canada with the number of intercepted illegal migrants declining almost 90%

- • Despite Canada fulfilling its promises of appointing a fentanyl czar and implementing a $1.3Bln security plan to reinforce the border, the US government has opted to initiate a trade war

- • If fully implemented, these tariffs would essentially eviscerate the terms agreed to under the Canada-US-Mexico Agreement, ending decades of free trade between these three countries

- • In a speech late last month, Bank of Canada Tiff Macklem warned the economic consequences of a protracted trade conflict would be severe and would represent the most significant trade shock since the 1930s

Market Reaction

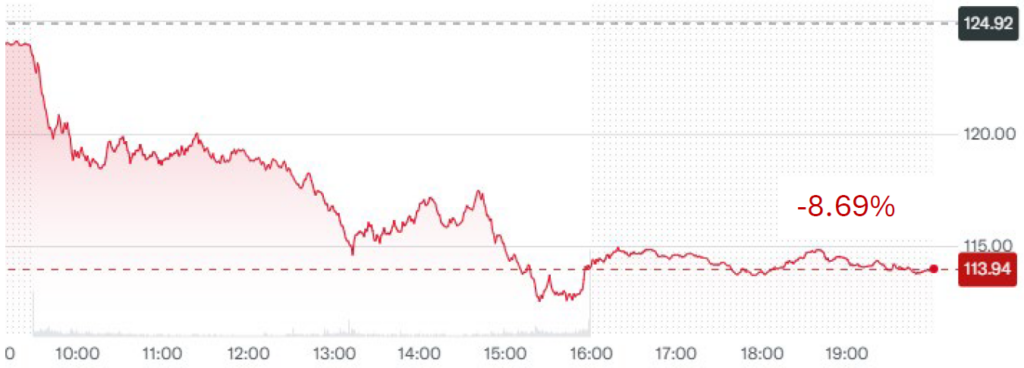

- • Moments after Trump confirmed the tariffs would go ahead, major stock indexes in Canada and the US plummeted

- • The TSX dropped 1.54% and the S&P500 posted its largest loss in 2025 with a decline of 1.76%

- • With respect to specific industries believed to be most impacted, strategists at Morgan Stanley have identified IT hardware and equipment, the auto sector and consumer products to be the most vulnerable.

NVIDIA Corporation

Source: Yahoo Finance

Source: Yahoo Finance

- • Top gainers following Trump’s announcement were primarily gold, precious metals and minerals companies.

- • The VIX also spiked as the announcement introduced further volatility into markets

CBOE Volatility Index (VIX)

Source: Yahoo Finance

- • Markets reacted similarly during Trump’s initial pronouncement to implement tariffs which may have influenced his decision to delay the tariffs the first time around

- • However, this time Trump appears resolute; the market moves that followed the previous threat may now look like foreshocks that come before a large earthquake

What does Trump really want?

- • The implementation of these tariffs will certainly raise revenue to finance Trump’s proposed tax cuts; however, the theory remains that Trump continues to use the threat of a trade war for negotiating leverage

- • According to the US Embassy & Consulates in Canada “Tariffs are a powerful, proven source of leverage for protecting the national interest. President Trump is using the tools at hand and taking decisive action that puts Americans’ safety and our national security first”

- • The data indicates clearly, however, that Canada’s border does not pose a threat to America’s national security; in that case what does the US want?

- • Based on recent events with Ukraine, the world has gained further clarity on Trump’s agenda – specifically the US government’s desire to secure access to critical minerals

What’s the big deal with rare earth and critical minerals?

- • Critical minerals have numerous commercial uses including mobile phones, solar panels, EV batteries, medical devices and military equipment

- • Canada’s critical minerals list identifies 34 minerals and metals which are considered by the Canadian government to be essential to Canada’s economic and national security as well as required for energy transition and export markets.

- • Natural Resources Canada prioritizes sixminerals — lithium, graphite, cobalt, nickel, copper and rare earth elements — for their potential to spur economic growth in key supply chains

- • Not surprising, many of these are also on a list of minerals important to the United States

- • Currently, China holds a monopoly over critical minerals essential for advanced technologies and defence, two areas where the U.S. wants to increase domestic manufacturing and production

- • The US sources most of its critical minerals from China or Chinese-owned firms operating in other countries; this dependence has created a security vulnerability which the US is seeking to remedy by securing other sources

- • Canada is home to five critical minerals essential for U.S. defence: gallium, niobium, rare earth elements, cobalt and tungsten

What Can Canada Do?

- • The federal government has reiterated its previous stance that if Trump’s tariffs go into force, Ottawa will retaliate with tariffs of up to $115 billion on US products

- • Based on a recent poll, 73% of Canadians support a policy where Canada matches any tariffs imposed by the US on a dollar-for-dollar basis

- • As well, we can expect renewed discussion on the possibility of cutting off shipments of oil, gas and electricity to the United States or alternatively, imposing steep export taxes on energy

- • Leveraging Canada’s abundance of critical minerals could also be an important tactic to strengthen Canada’s hand in tariff negotiations

- • In addition, the anger with the US administration has fueled a surge of ‘patriotic shopping’ to buy Canadian. However, this trend has its challenges when it comes to price disparities with cheaper American goods and the complexity of knowing what truly is made in Canada

What Must Canada Do?

- • While trade retaliation will be necessary, Canada must also look inward to address our declining competitiveness and sluggish productivity

- • Our economic and physical proximity to the world’s largest economy has caused Canada to ignore investments in security, overlook impediments to internal trade and neglect national infrastructure investments

- • Canada’s productivity has been in a prolonged slump, while productivity in the US in continues to rise; in comparison to other developed economies, Canada continues to lag on investment in machinery, equipment and intellectual property

- • Our economy needs innovative public policy and taxation that rewards smart risk taking and removes barriers for entrepreneurs

- • In addition, leaders need to re-ignite the conversation on building an east-west oil pipeline to carry oil and gas across the country and bypass the US

- • As a nation, we need to answer this “wake up call” – over the past month, we have seen the country become more united and committed to meaningful change – we need to keep this momentum

- • Our rallying call should not just be to “Buy Canada” but more importantly, to “Build Canada”

What Does It Mean for Investors

- • Now more than ever, it is important to work with your investment advisor to help you stay focused on your long-term goals.

- • Your advisor can help you maintain your strategic asset allocation and the appropriate diversification across asset classes and geographies to manage potential volatility.

- • Greater volatility can understandably be a source of investor anxiety, but it can also bring increased investment opportunities for seasoned investment professionals to find unique sources of returns

- • Private market investments can also provide advantages during uncertain times, providing steadier returns and more downside protection due to greater investment control and defensive investment terms.

- • Your Harbourfront team is well-equipped to answer your questions and help you navigate all market environment

If you would like to discuss your portfolio, please connect directly with your investment advisor.

Disclaimer

I, Theresa Shutt, have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management Inc. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.

Tariff Table Tennis Continues

7 March 2025